By legislation, GST registered companies are required to accomplish and report their GST claims to the Inland Revenue Authority of Singapore (IRAS) through the standardised GST F5 Form. Goods and Services Tax or GST is a broad-based consumption tax charged in addition to the price of imported goods, as well as a wide-ranging category of goods and services in Singapore.

Reporting GST returns via GST F5 Form to IRAS

The deadline for submission of the GST F5 form is within one month from the end of an accounting period. There is a total of 4 accounting periods for a year, and each accounting period consists of 1 quarter period. For instance, if your company has a financial year-end of 31 December 2019, you are required to submit the GST F5 form by 31 January 2019 for the quarter period from October to December 2019. Note that a penalty amounting to SGD 200 will be imposed for late submissions. As with all IRAS forms, the GST returns form can be downloaded from the myTax portal. This online website portal for submitting various tax-related forms can be accessed directly from the IRAS website. Forms should be reported in Singapore Dollars, and any foreign currencies balances must be converted to Singapore Dollars.

GST F5 Form Contents and 15 Key Boxes

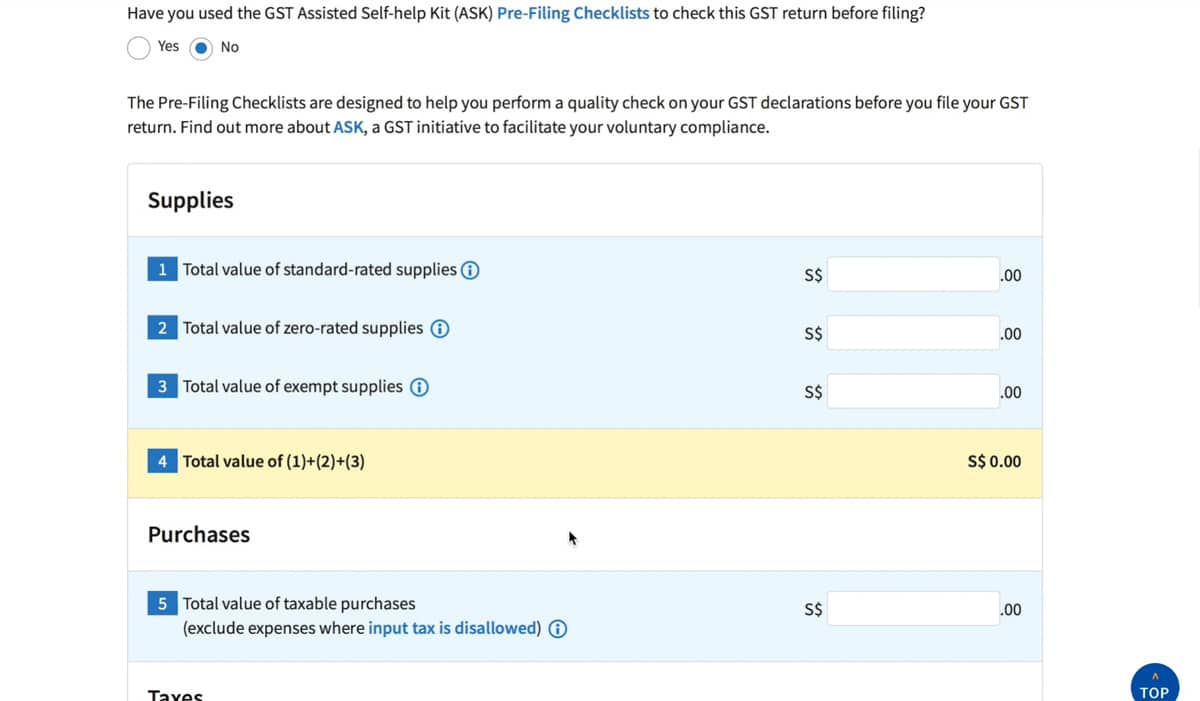

- Box No. 1- the total value of standard 7% rated supplies is required. The amount should exclude GST. For instance, if you had generated shoe sales amounting to SGD 1 million before GST and SGD 1.07 million with GST, you should fill in this box with SGD 1 million.

- Box No. 2- the total value of zero-rated supplies is required. These are usually export products where GST is not charged at all. Documents supporting this zero-rating should also be maintained.

- Box No. 3– the total value of exempt supplies is required. These include residential property transactions, provision of financial services and the sale of investment precious metals (IPM) in Singapore.

- Box No. 4- the total value of Box No. 1, 2 and 3.

- Box No. 5- the amount for the total value of taxable purchases is required. A company would have purchased raw materials or services from vendors who are GST registered as well in Singapore. These vendors would have billed GST on top of the price of goods. Hence, standard rated purchases eligible for GST claims and zero-rated purchases are required to be billed in this Box. Similar to Box No.1, the total value should exclude GST.

- Box No.6- the total output tax payable is required. This refers to all GST amounts charged to customers for all sales that happened in the relevant accounting period. It should be net of credit notes issued or debit notes received.

- Box No.7- the total input tax receivable and refunds claimed is required. This refers to all GST paid or being charged by suppliers and vendors for goods supplied or services performed.

- Box No.8- the net GST payable to IRAS or the amount receivable/claimable from IRAS. It is basically the difference between the amounts in Box 6 and Box 7. A larger amount in Box 6 (ie. a larger output tax compared to the input tax in Box 7) would result in net GST payable to IRAS.

- Box No.9- applies to businesses under the Major Exporter Scheme (MES), Approved Third Party Logistics Scheme (3PL) and other Approved Schemes only. IRAS would need to know the total value of goods imported under these schemes.

- Box No.10- the amount claimed for GST refunds made to tourists if it is applicable to your company.

- Box No. 11- required for any bad debt relief claims made.

- Box No. 12- only applicable to companies submitting their first GST returns.

- Box No.13- the value of total sales or revenue is required.

- Box No. 14- applies to import services subject to the Reverse Charge regime (RC Business). Starting on 1 January 2020, RC Businesses would be required by IRAS to account for GST on services sourced overseas.

- Box No. 15- another new box to be included in the GST F5 form starting from 1 January 2020. Box 15 requires electronic marketplace operators to input the total value of digital services provided where GST is applied.

Starting on January 2020, there will also be additional fields to be accomplished by businesses approved under the Import GST Deferment Scheme (IGDS) however these won’t be required by the IRAS for businesses not included under the IGDS.

While IRAS provides a basic guide to accomplishing tax forms online, consulting a qualified tax professional can help Singapore businesses efficiently accomplish and process their GST F5 Form submissions on time.

Related Posts

Tax Guide: Singapore Capital Allowances

By law, all Singapore Companies are required to file annual income tax returns to the…

Quick Guide: IAS 20 – Accounting for Government Grants

This year, the COVID-19 crisis has adversely impacted the global economy. Singapore is no exemption,…

Singapore Guide: ISCA FRB 6 – Accounting for Jobs Support Scheme

This year, the COVID-19 pandemic has inevitably adversely impacted the global economy. Singapore companies and…

Quick Guide: Singapore’s Enhanced Jobs Support Scheme (JSS)

The Singaporean government launched the Jobs Support Scheme (JSS) in late April as part of…