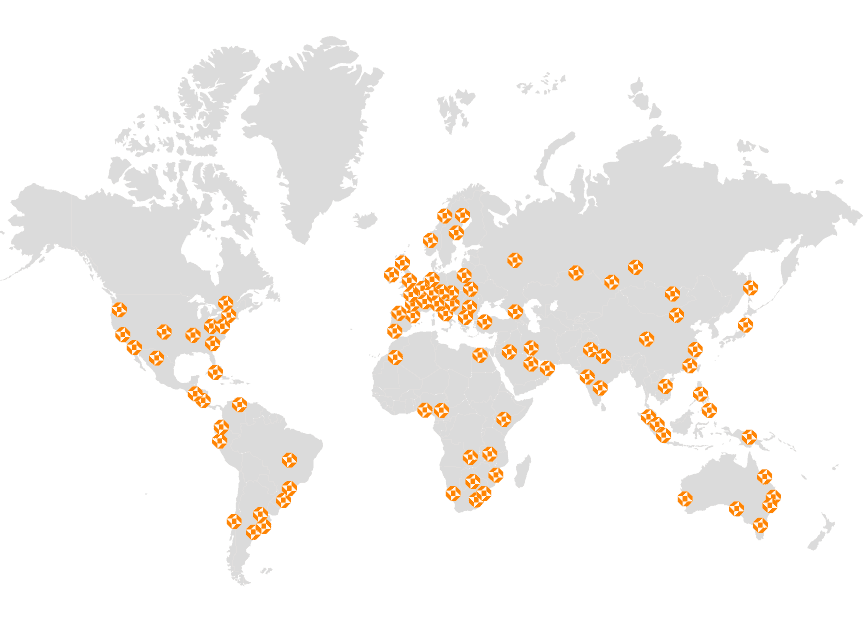

Morison Global

A Leading Global Association of Professional Service Firms

Our global reach has assisted many clients grow their international businesses. Expanding internationally come with challenges in understanding different geographical markets, cultural specificities and different regulatory frameworks.

Bringing to you a single point of contact, our objective is to facilitate and provide a one-stop service line, to create trust for our clients and to ensure our global members are briefed of the service requirements. Together with our members within the Morison network, we can provide our clients with our valuable professional advice at very reasonable and affordable fees.