Depositary receipts gained immense popularity as they offered a simplified means for investors to gain exposure to international markets. ADRs, in particular, became a staple in U.S. portfolios, allowing investors to diversify globally with the convenience of trading on U.S. exchanges. However, recent trends indicate a shift, with more foreign private issuers opting to list directly on U.S. exchanges rather than through DR programs.

The Evolution of Depositary Receipts

Depositary Receipts (DRs) have played a pivotal role in facilitating cross-border investments for nearly a century. Initially, U.S. investors faced numerous barriers when attempting to invest in foreign companies, such as different currencies, diverse accounting standards, and unfamiliar regulatory environments. Introduced in the 1920s, American Depositary Receipts (ADRs) were created to help U.S. investors buy shares in foreign companies without the complexities of dealing with foreign securities regulations. ADRs provided a solution by allowing shares of foreign companies to be traded on U.S. stock exchanges in a manner similar to domestic stocks.

Following the success of ADRs, the financial industry saw the development of Global Depositary Receipts (GDRs) and European Depositary Receipts (EDRs), catering to investors in various regions. GDRs facilitated trading on multiple international markets, thus broadening the scope of DRs beyond the U.S. and enhancing their utility for global investors. EDRs, on the other hand, were designed for trading in European markets, providing similar benefits to European investors.

The evolution of DRs has also been marked by advancements in technology and changes in regulatory frameworks. The digitization of financial markets and the development of sophisticated trading platforms have further streamlined the process of investing in DRs, making it easier and more efficient for investors worldwide.

There are currently four major Depositary Banks dominating the structure, which are led by Bank of New York, Citibank, Deutsche Bank and JPMorgan. These banks are integral in issuing and managing DR programs. They act as intermediaries between the foreign companies and the investors, handling the issuance, custody, and dividend payments for DRs. Their role ensures that the financial integrity and regulatory compliance of the DRs are maintained, providing assurance to investors.

Understanding ADRs and GDRs

ADRs (American Depositary Receipts) are negotiable certificates issued by U.S. banks representing shares of a non-U.S. company. These are traded on U.S. exchanges like regular stocks. GDRs (Global Depositary Receipts), on the other hand, are similar instruments that can be traded in multiple markets outside the issuer’s home country, typically listed on European exchanges.

How Depositary Receipts Work?

DRs function through a depositary bank which issues the receipt in the investor’s home market. The underlying foreign shares are held by a custodian bank in the issuer’s home country. Investors benefit from the convenience of trading DRs as domestic securities while still gaining exposure to foreign assets.

Size of the Depositary Receipts market

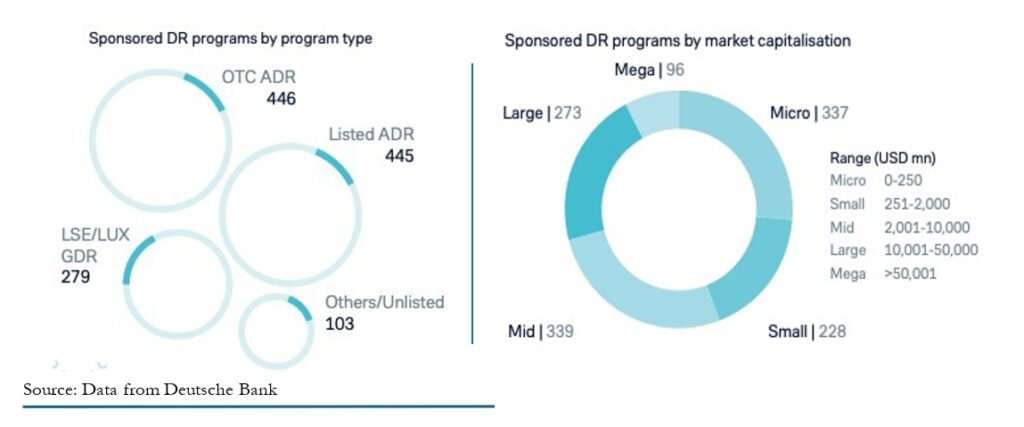

There are two primary types of DRs: sponsored and unsponsored. Sponsored DRs are established in cooperation with the foreign company, which usually enters into a formal agreement with a depositary bank to handle the issuance and management of the DRs. These programs often come with additional benefits, such as voting rights, which allow DR holders to vote on corporate matters similar to direct shareholders. Unsponsored DRs, on the other hand, are created without direct involvement from the foreign company, typically by one or more depositary banks, and generally do not provide voting rights to holders.

As of 2023, DRs encompass 2,723 issuers representing roughly 70 countries. According to Deutsche Bank’s data published in 2023, there are 1,273 sponsored DR programs globally, with a breakdown of 445 companies listed on the NYSE and Nasdaq. The rest of sponsored DRs are listed on the OTC, LSE and other markets.

The presence of DRs in these varied markets reflects their flexibility and adaptability to different regulatory environments and investor preferences. The OTC markets, for example, offer a less stringent regulatory framework, which can be attractive to smaller or emerging companies looking to enter the U.S. market with lower compliance costs and administrative burdens. Meanwhile, the LSE and other international exchanges provide access to European and other regional investors, enhancing the global reach of the issuing companies.

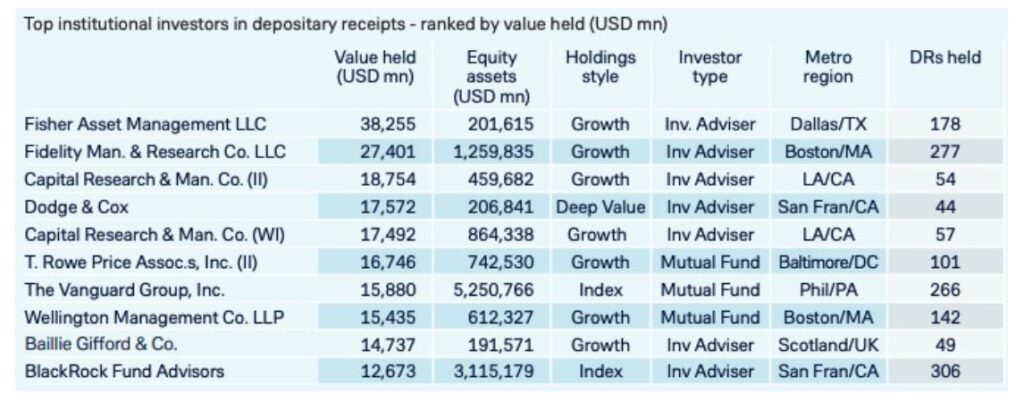

Institutional Ownership of Depositary Receipts

The ADR market is substantial, with hundreds of billions in market capitalization. U.S. institutional investors, mutual funds, and retail investors actively trade ADRs, attracted by the opportunity to diversify their portfolios internationally while dealing in familiar U.S. market dynamics.

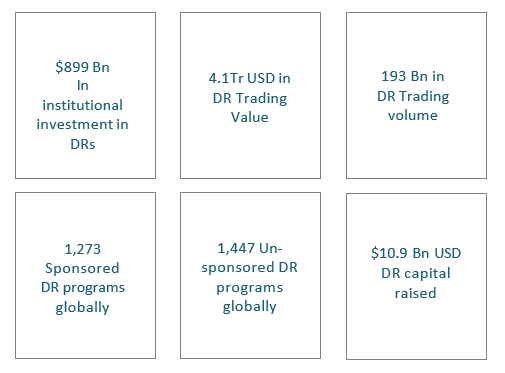

The current total DR institutional ownership represents roughly $899bn in market value. With a total of $4.1bn USD value being traded in 2023. It is evident that top institutional investors are continuing to have great interest in the sponsored ADR programs. North America remains by far the concentration center of depository receipts investment.

The Relevance of DRs Today

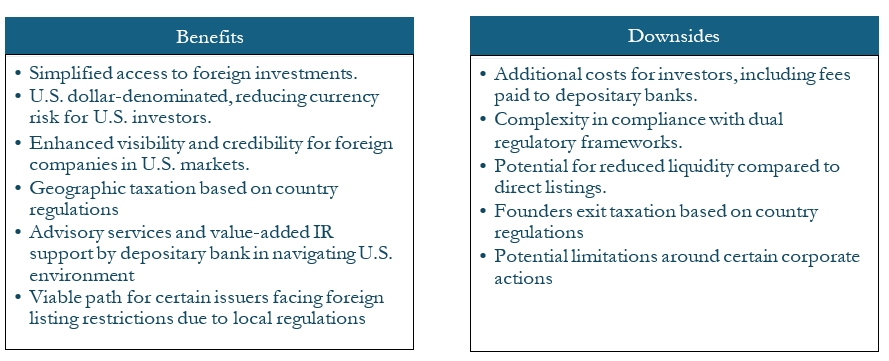

While DRs have historically been crucial in bridging international markets, the landscape is changing. Smaller foreign private issuers increasingly prefer direct listings on U.S. exchanges, bypassing the DR route. This trend is driven by the desire to avoid the additional costs and complexities associated with DR programs, as well as the increased sophistication and global reach of modern investors.

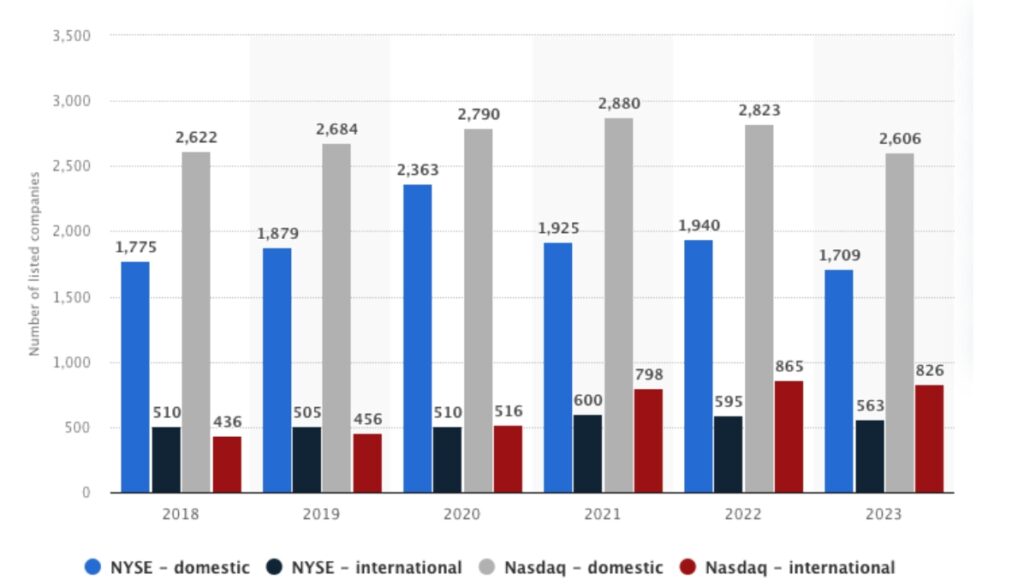

There are approximately 1,389 foreign private issuers listed on the U.S. exchanges. Not all foreign companies are listed through ADR programs. Roughly 944 foreign companies are listed directly on the U.S. exchanges directly without DR programs.

Comparison of the number of listed companies on the NYSE and Nasdaq from 2018 to 2023 by domicile

Nasdaq makes up majority of the foreign private issuers with roughly 826 representing 51 countries.

The data indicated roughly 207 of the foreign private issuers are ADRs listed, the remaining companies are common share listed, with principal offices outside of the U.S.

The NYSE indicated a total of roughly 530 companies are listed, spanning across 45 countries.

According to the data, roughly 245 companies are sponsored ADRs. The rest of the foreign private issuers are listed directly through common equity on the Exchange. There are also number of Canadian companies listed directly without depositary receipts.

The Future of ADRs

The shift towards direct listings suggests a potential decline in the relevance of ADRs, especially for smaller companies. However, ADRs may still hold value for larger firms seeking to tap into U.S. capital markets without fully integrating into the U.S. regulatory environment. The future of ADRs will likely depend on their ability to adapt to the evolving needs of global issuers and investors, balancing the benefits of accessibility and convenience with the demands of a dynamic financial ecosystem.

In conclusion, while the traditional role of DRs is being challenged, their obsolescence is not yet certain. As foreign private issuers and investors navigate these changes, the financial industry will need to reassess the value proposition of DRs in a globalized market.

Foreign companies looking to enter the U.S. markets for IPOs should consider the advantages of the Depositary Receipt program. Practitioners in the legal field, investment banking, and advisory roles may sometimes lack a comprehensive understanding of Depositary Receipts and their complexities, particularly if they have limited experience with international issuers. DR programs offer valuable assistance and enhance operational efficiency for smaller companies, particularly those with limited resources. Using a transfer agent can facilitate direct listing without the requirement of a depositary receipt program. It’s like driving a car without a seatbelt.

*Disclaimer

The opinions here are solely those of SRO Partners and do not represent any recommendation or offer to buy or sell securities. SRO Partners makes no representations or warranties as to the accuracy of the information contained herein. SRO Partners disclaims any and all liability arising from errors or omissions contained in this presentation, which is to be used for informational purposes only and does not constitute investment advice. SRO Partners is not an Investment Advisor or a Registered Broker Dealer under FINRA

Reference:

https://www.sec.gov/files/adr-bulletin.pdf

https://www.bnymellon.com/content/dam/bnymellon/global- assets/documents/content/depositary-receipts-opportunity-product- paper.pdf

https://tss.gtb.db.com/FileView/Data.aspx?URL=dbdr/cms//DR%20 Annual%20Review%202023-3aedccc.pdf

https://www.adr.db.com/drwebrebrand/about-drs/adrs/types-of-adrs

https://depositaryreceipts.citi.com/adr/common/linkpageC.aspx?pageI D=2&subpageID=9

https://depositaryreceipts.citi.com/adr/common/file.aspx?idf=6329

Related Posts

✨ Happy Deepavali! ✨

Wishing you and your loved ones a joyous and prosperous festival of lights! May this…

New S$75m grant to enhance Singapore as an enterprise financing hub

Singapore, 14 January 2019 – The Monetary Authority of Singapore (MAS) will launch next month…

SGX, Third500 to build emerging growth IPO market

THIRD500, the Singapore-based affiliate of US investment bank, Healthios Capital Markets LLC, on Monday said…