What is VAT and How Does It Work in Singapore?

Value-Added Tax (VAT) is a type of indirect tax collected on the value of goods and services consumed by individuals and businesses to alleviate the effect of direct taxes such as income tax. In Singapore, VAT is known as Goods and Services Tax (GST) and it is applied to most of the products and services,…

Read morePOSTED BY

Tax Dept

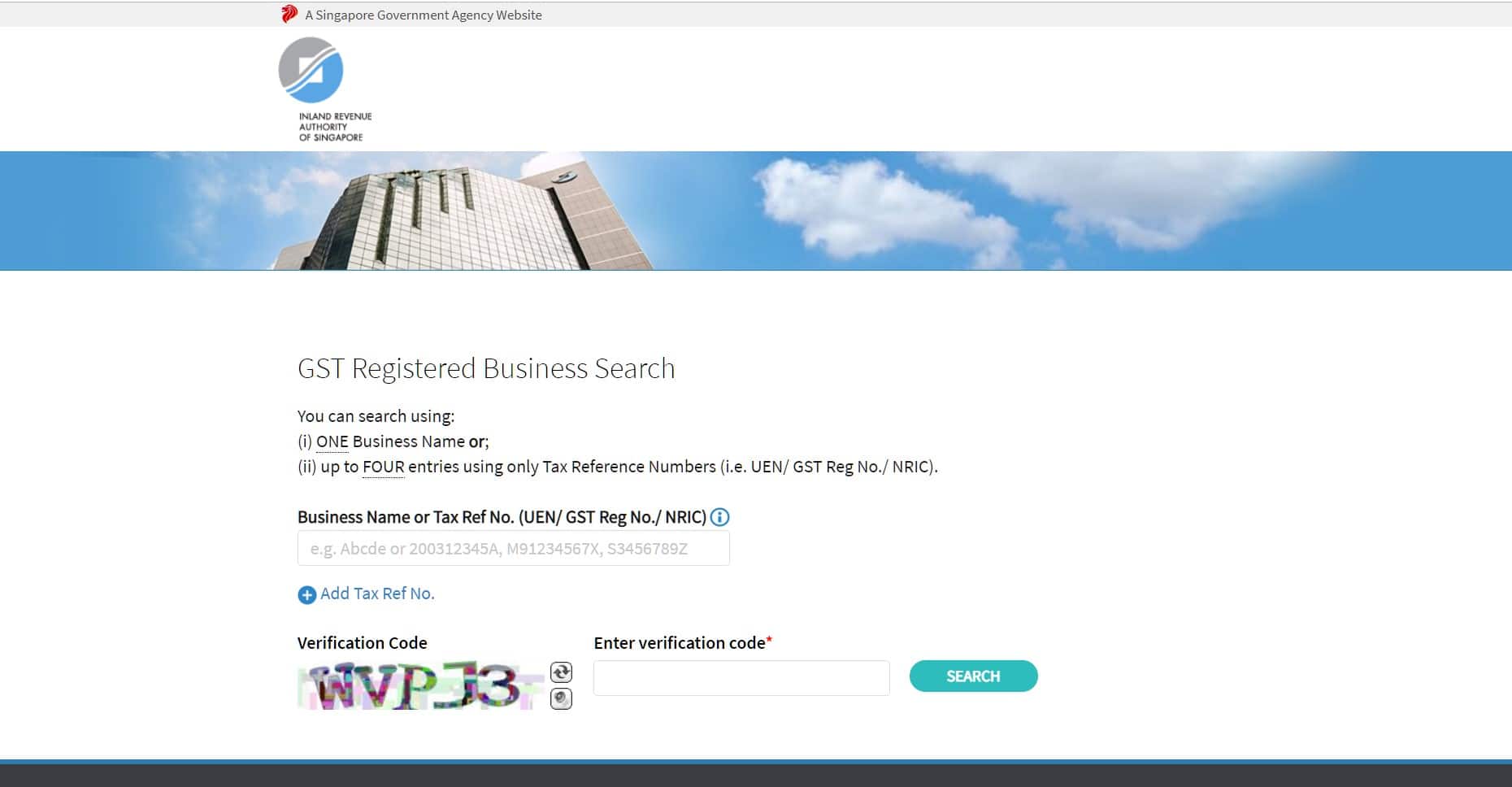

Singapore Tax Guide: Check a Company’s GST Registration Number

By Singaporean legislation, a GST registered company may claim back GST incurred on business expenses and file quarterly GST returns to the Inland Revenue Authority of Singapore (IRAS). Goods and Services Tax or GST is a broad-based consumption tax charged in addition to the price of imported products, as well as a wide-ranging category of…

Read morePOSTED BY

Tax Dept

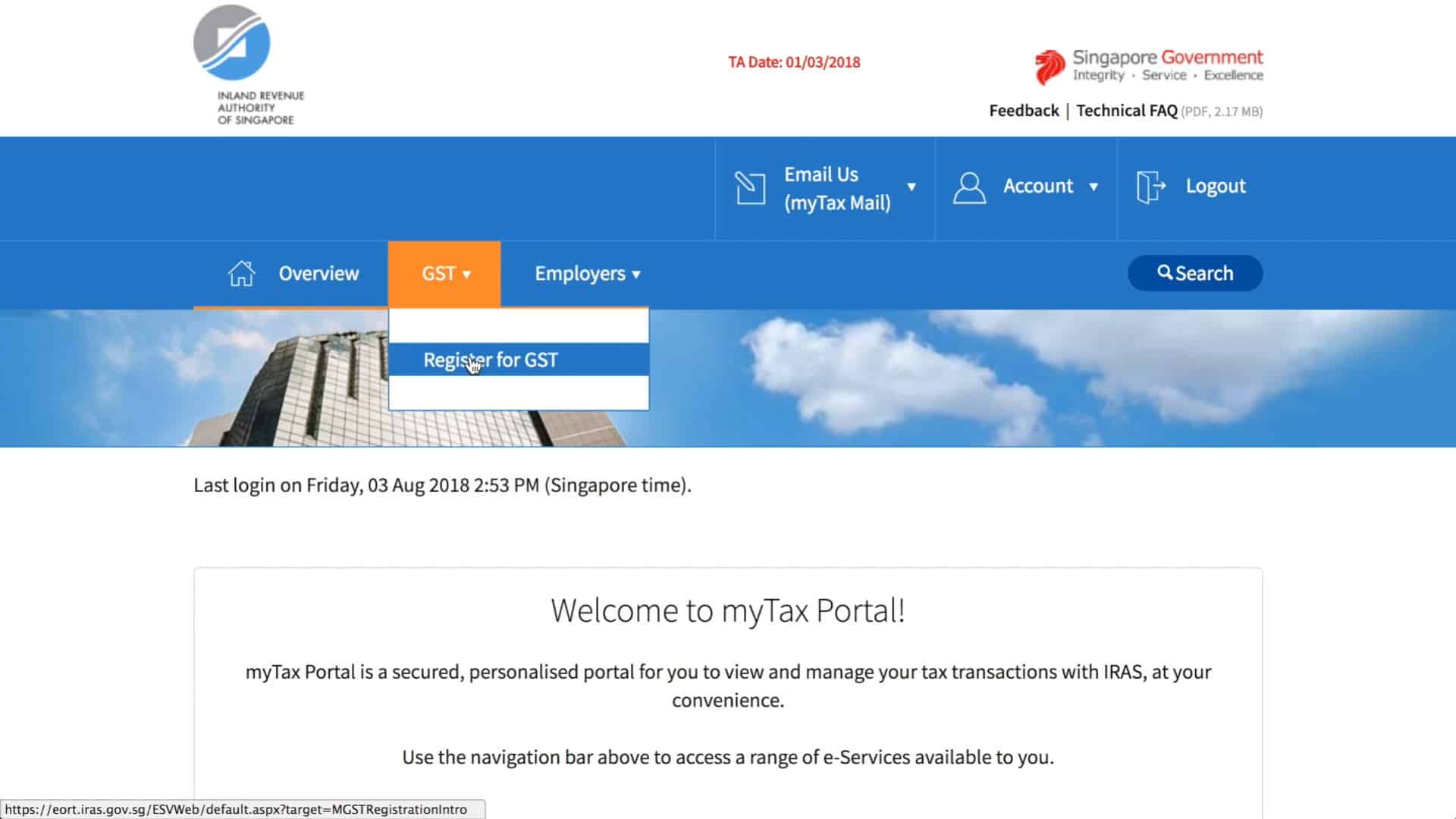

Singapore Tax Guide: Acquiring a GST Registration Number

As per Singaporean legislation, individuals and companies are required to file annual income tax returns to the Inland Revenue Authority of Singapore (IRAS). Companies that apply for GST are given a GST registration number for identification purposes. GST registered companies may then file tax claims for business expenses as well as submit quarterly GST returns…

Read morePOSTED BY

Tax Dept

Conditions for becoming a GST Registered Company in Singapore

By Singaporean legislation, the Inland Revenue Authority of Singapore (IRAS) is tasked with the administration of taxes for individuals and companies in the city-state. When filing annual income tax returns, a GST registered company may claim back GST incurred on business expenses and quarterly GST returns are submitted to IRAS. What is GST? Goods and…

Read morePOSTED BY