Tax Guide: Singapore Tax Identification Number

A Tax Identification Number (TIN) is a unique set of numbers specifically assigned to an individual or organization to create a “fingerprint” that can facilitate their identification for the government and its agencies. In Singapore, individuals are assigned a Tax Reference Number issued by the Inland Revenue Authority of Singapore (IRAS) and businesses and other…

Read morePOSTED BY

Tax Dept

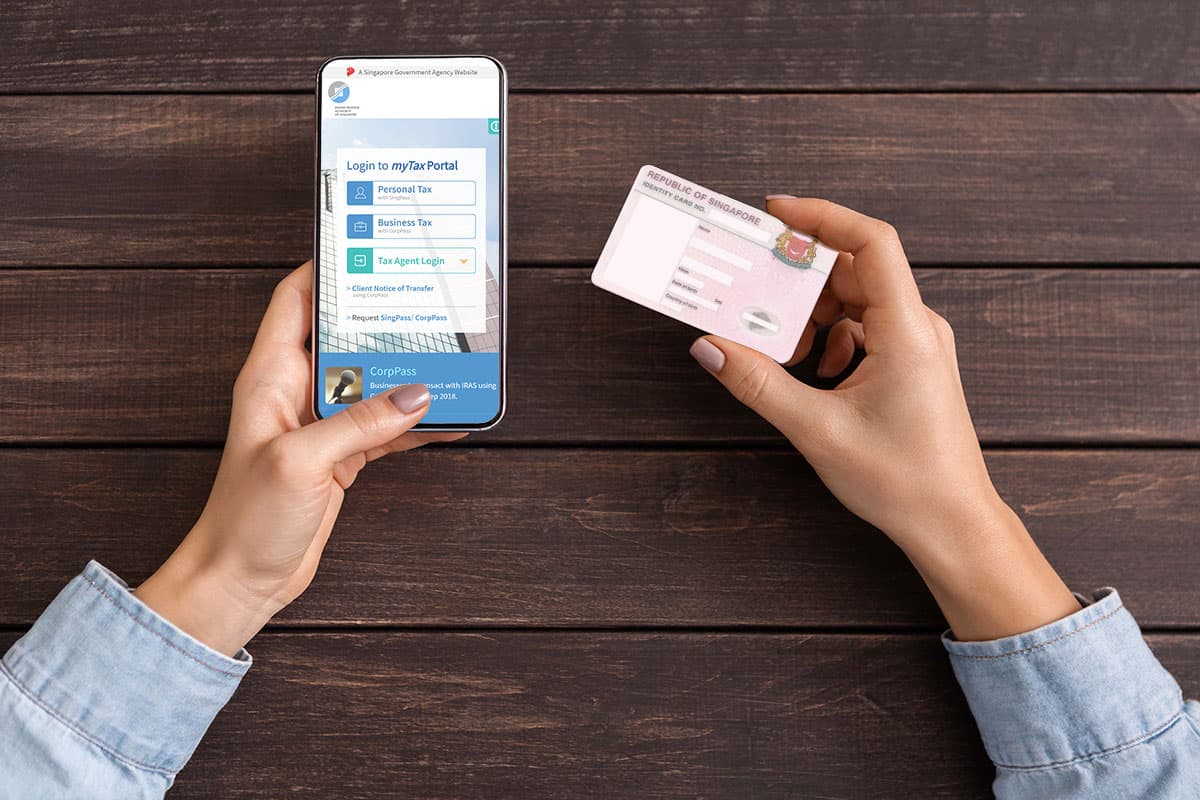

IRAS Portal Guide: How to login to the myTax Portal

The Inland Revenue Authority of Singapore (IRAS) has a dedicated IRAS login portal for individuals or corporations to perform various tax e-services online. Individuals are required to file annual income tax returns to (IRAS) and pay income tax at the prevailing Singapore personal IRAS income tax rate charged on chargeable income. Companies are also required…

Read morePOSTED BY

Tax Dept

Double Tax Deduction in Singapore: Tax Facts

As per Singaporean legislation, individuals (employees or sole proprietors) and companies are required to file annual income tax returns to the Inland Revenue Authority of Singapore (IRAS). Among the tax incentives implemented by IRAS are double tax deductions for businesses in the city-state. What is Double Tax Deduction (DTD)? Double tax deduction refers to cases…

Read morePOSTED BY