Using the GST F7 Form to Correct GST Filing Errors

Goods and Services Tax (GST) is an indirect tax collected by the Inland Revenue Authority of Singapore (IRAS) and it is applied to most goods and services sold to consumers and businesses within the country. GST must be reported and paid by companies every three months and this quarterly GST submission is usually prepared by…

Read morePOSTED BY

Tax Dept

Tax Review: Singapore Budget 2018 and 2019 GST Policy Changes

On the 20th of February 2018, Finance Minister, Mr Heng Swee Keat announced in his Singapore budget 2018 speech that the country’s GST rate will be increased from 7% to 9% starting from 2021 onwards. On the GST front, digital services such as Netflix subscriptions as well as apps purchased and downloaded via smartphone would…

Read morePOSTED BY

Tax Dept

Factors to Consider Before Applying for Voluntary GST Registration

By law, Singapore companies must apply for GST registration should they meet the sales threshold set by the Inland Revenue Authority of Singapore (IRAS). Companies that do not meet the criteria for compulsory registration may also apply for voluntary GST registration. Our basic guide can help businesses and companies decide if they should pursue voluntary…

Read morePOSTED BY

Tax Dept

Singapore IRAS GST legislation: Tax Facts

Goods and Services Tax or GST is a broad-based consumption tax charged in addition to the price of imported goods, as well as a wide-ranging category of goods and services in Singapore. GST is administered by IRAS and is more commonly known as the Value-Added Tax (VAT) in overseas developed countries such as Japan or…

Read morePOSTED BY

Tax Dept

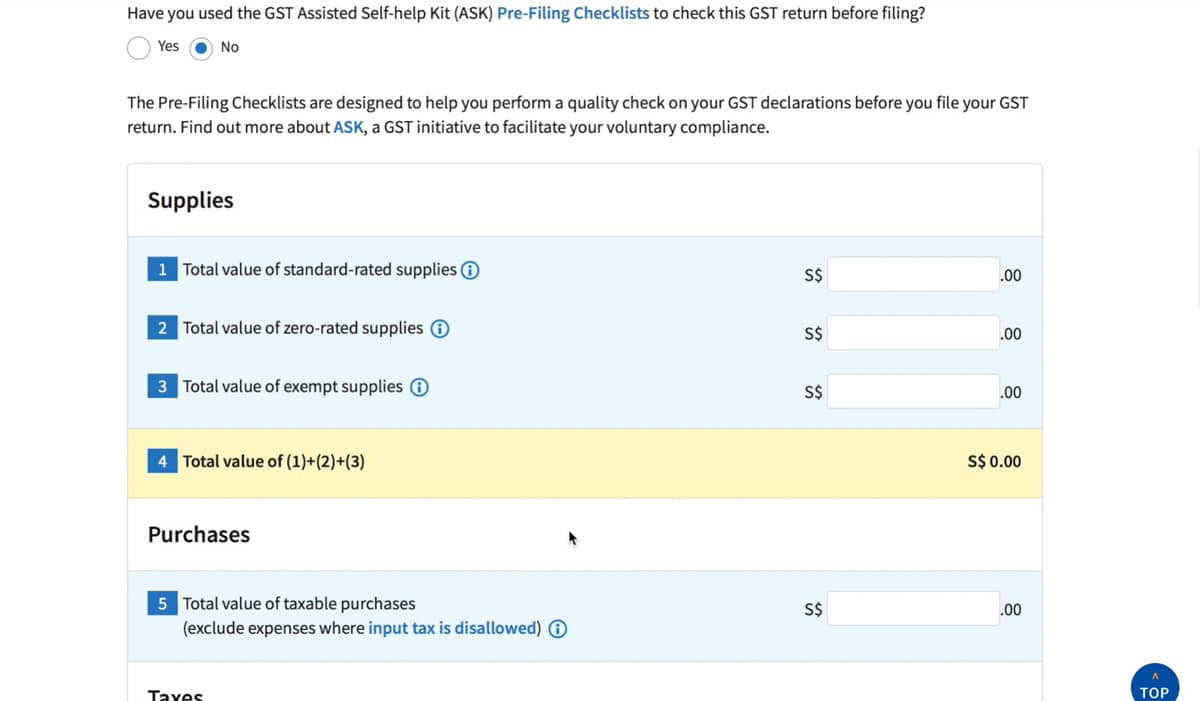

A basic guide to GST F5 Form Submission to IRAS

By legislation, GST registered companies are required to accomplish and report their GST claims to the Inland Revenue Authority of Singapore (IRAS) through the standardised GST F5 Form. Goods and Services Tax or GST is a broad-based consumption tax charged in addition to the price of imported goods, as well as a wide-ranging category of…

Read morePOSTED BY