Tax Guide: Personal Income Tax Filing in Singapore

Individual taxes in Singapore are defined and collected by the Inland Revenue Authority of Singapore (IRAS). This institution has established different tax brackets and conditions for residents and non-residents working in Singapore. This guide for locals and foreigners will outline the process for annual personal income tax filing in Singapore. Individual Taxes in Singapore The…

Read morePOSTED BY

Tax Dept

Singapore Corporate Income Tax Rebates

All Singapore companies are required to file annual income tax returns to the Inland Revenue Authority of Singapore (IRAS) and pay income tax at the prevailing Singapore corporate tax rate charged on chargeable income. A one-off corporate tax rebate may be granted for each Year of Assessment (YA) to reduce the final tax bill amount…

Read morePOSTED BY

Tax Dept

Corporate Income Tax Exemption schemes in Singapore

By Singaporean law, all companies in Singapore are required to file annual income tax returns to the Inland Revenue Authority of Singapore (IRAS) and pay income tax at the prevailing corporate tax rate applied to chargeable income. IRAS has put in place tax exemption schemes that are designed to reduce any tax liability burden for…

Read morePOSTED BY

Tax Dept

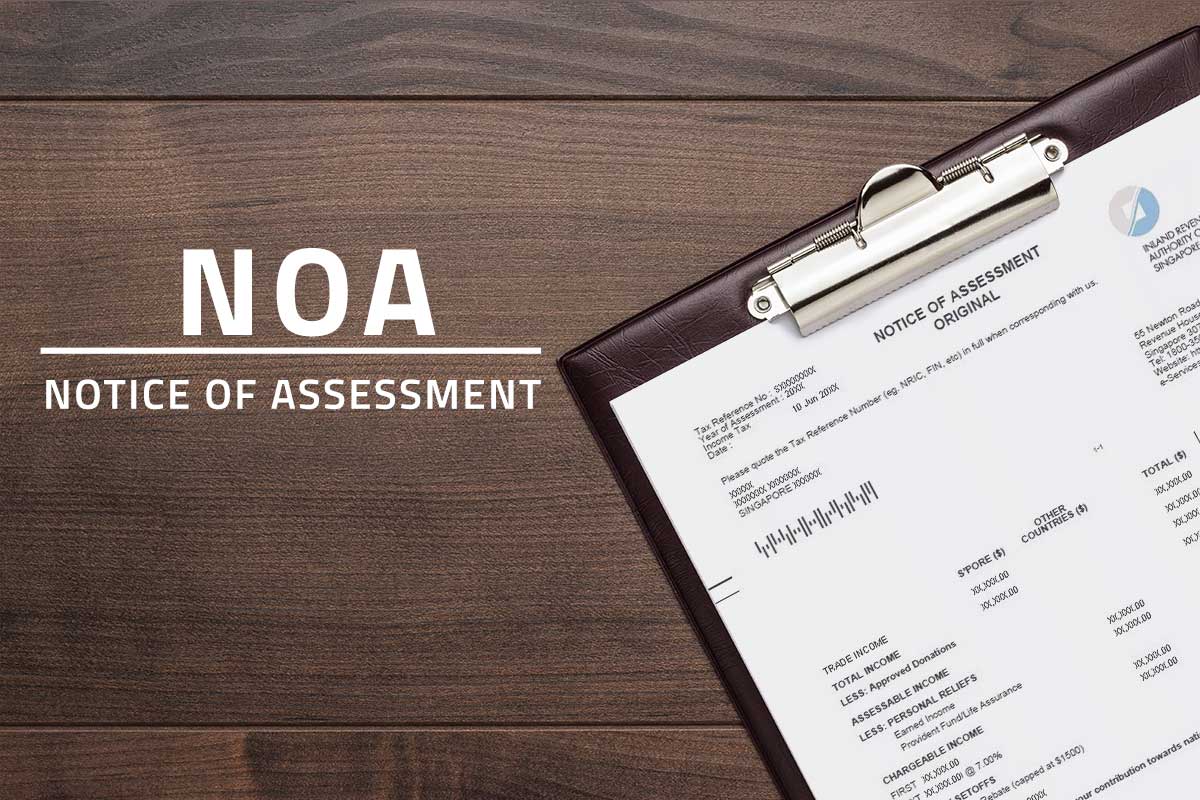

Understanding the Singapore Income Tax Notice of Assessment (NOA)

By Singaporean legislation, individuals (employees or sole proprietors) and companies are required to file annual income tax returns to the Inland Revenue Authority of Singapore (IRAS). To ensure compliance with Singapore’s tax laws, it’s important for taxpayers to be familiar with the forms and documents included in the tax settlement process. What is a Notice…

Read morePOSTED BY

Tax Dept

Singapore Tax Guide: Preparing for IRAS Income Tax filing YA2020

Companies are required to file annual income tax returns to the Inland Revenue Authority of Singapore (IRAS) and pay income tax at the prevailing Singapore corporate tax rate charged on chargeable income. The final IRAS tax rate will then be levied on the chargeable income which will work out the final tax amount payable to…

Read morePOSTED BY