As in 2008/2009, Singapore is reeling into a recession – factory output shrank 2.20% in August as compared to the corresponding period. electronics sector shrank by 7.3% and transport engineering shrank by 20.1%.

Whilst the slowdown is widely expected, the steep fall caught many by surprise. The writer is of the view that recession is forthcoming.

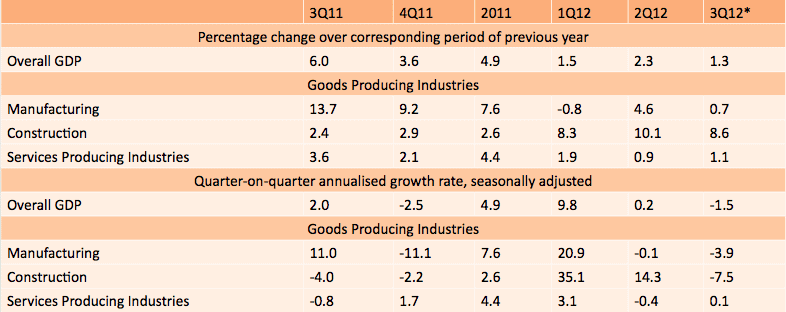

Economic growth was better than expected particularly from the construction sector on industrial and residential projects. Indicative GDP growth in each quarter is summarized below:

It is a steep downward trend and things could set worse. World economies are not expected to improve. The uS is going through the Presidential ‘election Period’. Things will slow down notwithstanding – Qe3 measure (Quantitative easing 3). The impact on the economy is small – very simple, the ‘hole’ is too big and any Qe3 is just a drop of water in the ocean and will disappear very fast. unemployment remained close to 8%, housing price are almost flat and consumer spending is on the decline. The european crisis is deepening with Spain taking a centre stage now – Spain is bankrupt and is seeking bailout from both the eCB and IMF.

The list will get longer with Italy and Portugal added to possible candidates for a bailout. The eCB in August agreed to lend to troubled eeC countries and without limit to these ailing economies.

Question: Can it afford to do that? Will Germany being the main contributor to the eCB agree to it in the long run?

China another economic giant saw its GDP dropped from 8.9% in 2011 to 7.6% in the second quarter of 2012 and this is expected to fall to 7.5% in the third quarter. The economy is expected to steep dive till the first quarter of next year and hopefully the new leaders taking over the helm will do something to lift the China’s economy.

Singapore will be hit very hard. GDP is expected to fall to a low of 1.2% for last quarter 2012 and minus 7% (-7%) for 2013. So tighten your belts and brace for dark clouds and storms ahead.

Related Posts

🎅🎄 Merry Christmas! 🎄🎅

Wishing you all the joy, peace, and love this festive season brings. ✨ #Christmas #paulwanco…

✨ Happy Deepavali! ✨

Wishing you and your loved ones a joyous and prosperous festival of lights! May this…

Paul Wan & Co Group Bonding Event Da Nang 2024

Paul Wan & Co group celebrated our 38th anniversary with a big bang retreat in…

🌕✨ Happy Mid-Autumn Festival ! 🎑🐇

As the full moon shines bright, we send our warmest wishes to our valued clients,…