By Singaporean legislation, individuals (employees or sole proprietors) and companies are required to file annual income tax returns to the Inland Revenue Authority of Singapore (IRAS). To ensure compliance with Singapore’s tax laws, it’s important for taxpayers to be familiar with the forms and documents included in the tax settlement process.

What is a Notice of Assessment (NOA)?

The IRAS Notice of Assessment (NOA) is a tax bill which details the chargeable income and final tax payable amount that is required for settlement by companies or individuals. For Singapore companies, a NOA is issued after successfully filing for Estimated Chargeable Income (ECI) or an estimate of tax payable for the respective annual Year of Assessment. For individuals, a NOA is issued after the final personal income tax filing is submitted. The mode of settlement, detailed instructions for payment and relevant deadlines are also included in the NOA document format.

How to obtain a copy of Tax Bills or the NOA

Individuals and Companies can view and print a copy of their tax bills from the IRAS myTax Portal. Individuals need to log in with their SingPass details while corporations must use their CorpPass login details to access the portal on the IRAS website. Taxpayers may also request a printed copy of the NOA and related documents from the Taxpayer and Business Service Centre at Revenue House. Company representatives must first set an appointment at least two working days in advance before claiming the physical copies of these documents.

NOA for Singapore Companies

For corporate income tax filing, there are 4 different types of NOAs:

- Type 1 – NOA issued after ECI is filed by tax agents or the company itself.

- Type 2 – NOA issued by IRAS due to company not filing for ECI within 3 months after their financial year-end, company not filing for Form C or C-S within IRAS deadline, lower ECI declared or an Advance Tax Assessment issued by IRAS.

- Type 3 – NOA issued based on tax Form C and Form C-S filed by the company.

- Type 4 – Final tax assessment issued by IRAS. Any objection to the final NOA must be made within 2 months from date of the issued tax bill.

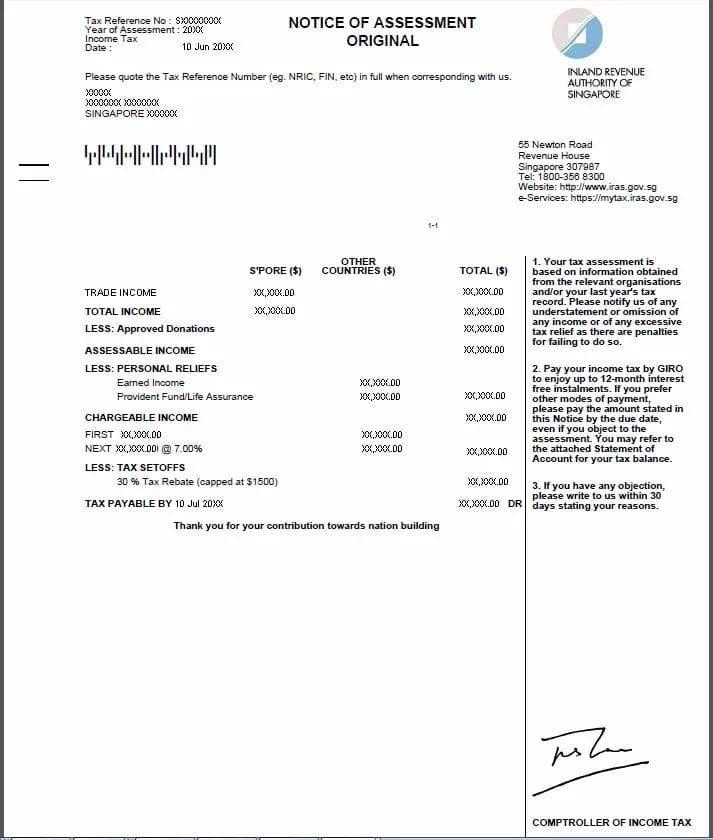

How to read NOA for Singapore Companies

The NOA consists of several key information. First would be the assessable income amount. This details the total income reported as per the ECI, Form C or Form C-S filing. Chargeable income is included in the NOA as well. The prevailing tax rates for the respective YA is applied on this chargeable income amount and breakdown is showed to derive the Tax payable. Tax payable amount would be the final tax bill payable to IRAS. A Tax Repayable/Discharged amount will be printed on the NOA in the event the final tax bill is lower compared to tax paid in for NOA issued after ECI filing, triggering a tax refund by IRAS.

Methods to settle tax payment to IRAS

Payment options for settlement of tax bills are through GIRO, online banking, cash, NETS, cheque, cashier’s order or telegraphic transfer. Settlement of NOA must be made within 1 month as per the deadline stated in the NOA. Penalties amounting to 5% of tax bill will be imposed for any late payments.

Singapore companies can view and print a copy of the NOA and other documents via mytax.iras.gov.sg. A hardcopy NOA will also be sent to the registered business address of the company.

Filing an objection to NOA

The company can file a formal objection to IRAS NOA assessment. A Notice of Objection to IRAS can be made via the myTax Portal. Any objection must be made within 2 months from NOA date. For example, if the NOA date falls on 13 December 2019 and the company does not agree with the NOA, the final deadline to submit a Notice of Objection to IRAS is 13 February 2020.

How to read NOA for Individuals

NOA for individuals details the assessable income as well, similar to NOA for Singapore companies. However, the income sources are different. Individuals’ income source would be from trade, employment and other rental income. Instead of deductible expenses, individuals are allowed to claim for personal reliefs and these reliefs are listed out in the NOA. A final chargeable income is computed and shown in the NOA. A breakdown to derive the final tax payable is spelled out in the NOA as well.

Individuals can obtain a copy of the NOA via mytax.iras.gov.sg and login using their Singpass details. Method of payments include lump sum payment via online banking or other payment methods. A 12 month Instalment payment settlement plan is also available for GIRO deduction as authorized by the respective individual.

The NOA is an important tax document that should be kept securely for future reference and in case any need to file for objections may arise. Seeking the advice of a qualified tax professional is a good option to get your tax filing procedures in order. Finding the right tax partner with considerable experience in interpreting NOA items will also minimize any discrepancies in a company or individual’s tax documents thus ensuring compliance with Singapore’s tax filing legislations.

Related Posts

Tax Guide: Singapore Capital Allowances

By law, all Singapore Companies are required to file annual income tax returns to the…

Quick Guide: IAS 20 – Accounting for Government Grants

This year, the COVID-19 crisis has adversely impacted the global economy. Singapore is no exemption,…

Singapore Guide: ISCA FRB 6 – Accounting for Jobs Support Scheme

This year, the COVID-19 pandemic has inevitably adversely impacted the global economy. Singapore companies and…

Quick Guide: Singapore’s Enhanced Jobs Support Scheme (JSS)

The Singaporean government launched the Jobs Support Scheme (JSS) in late April as part of…