The Inland Revenue Authority of Singapore (IRAS) has a dedicated IRAS login portal for individuals or corporations to perform various tax e-services online. Individuals are required to file annual income tax returns to (IRAS) and pay income tax at the prevailing Singapore personal IRAS income tax rate charged on chargeable income. Companies are also required to file annual income tax returns to the Inland Revenue Authority of Singapore (IRAS) and pay income tax at the prevailing Singapore corporate tax rate charged on chargeable income.

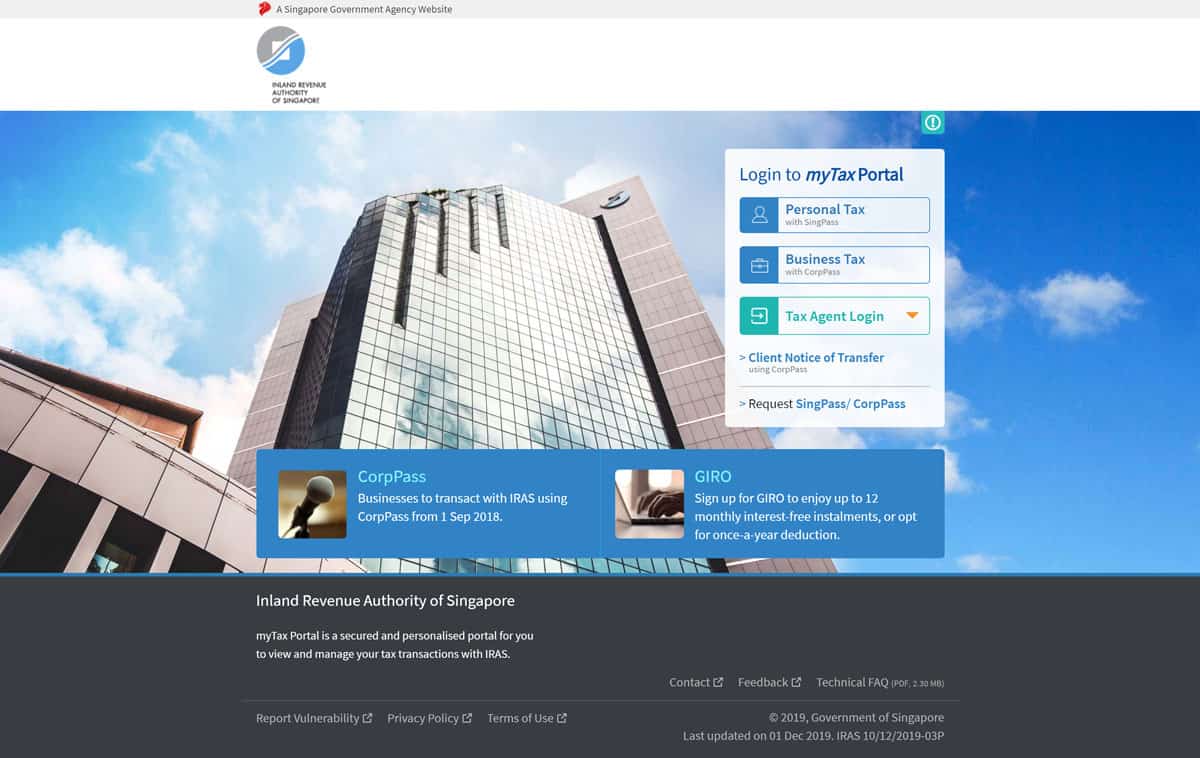

IRAS myTax Portal login process

The IRAS portal is an online hub for taxpayers to transact with IRAS electronically. It includes an archive of standard electronic forms for submission of annual tax filing and a tax e-mail function for receiving notifications from IRAS.

The IRAS portal may also be referred to as the myTax portal. In order to login to the IRAS tax portal, individuals need to have their SingPass login details ready. For corporations, CorpPass login details are required. Both the SingPass and CorpPass login details can be requested via the portal’s main home page under “>Request SingPass/CorpPass” link. Taxpayers must safeguard their login details to securely access the portal and perform tax filings or other tax administration matters.

IRAS myTax Portal e-services

For years, the IRAS has been encouraging individuals and companies to move their tax filings online electronically thus, standard forms such as Form C for annual corporate tax filing can now be submitted via the IRAS portal. This has the benefits of greatly reducing paper form submissions which can be cumbersome and slow.

Taxpayers can retrieve tax-related information from the portal. Corporations with appointed third-party tax professionals for handling their annual tax filing processes are also able to submit e-forms on behalf of the taxpayer where proper access is granted. Some e-services offered on the portal are individual tax filing, corporate tax filing, quarterly GST submission, property tax submission and e-stamping of contract documents.

In the case of individual taxpayers, some of the common e-services that can be completed via the portal include checking of employment income status, filing income tax returns and applying for GIRO. GIRO is an instalment plan for total annual tax payable. Businesses (companies, tax agents or income tax preparers) will mainly access the portal for submission of Estimated Chargeable Income (ECI), Form C or Form – CS every year. Companies may also use the IRAS online tax portal for GST related matters such as registration for GST, checking of GST registration number and filing for GST return. Property owners can use the online portal to check their property tax balances and for filing payment of relevant property taxes. Another popular e-service offered on the portal is the e-stamping of legal contracts such as Sale & Purchase Agreement, Tenancy Agreement or Share Transfer Mortgage.

In addition to studying various IRAS tax guides, engaging a qualified tax professional may be a good option to ease one’s tax filing procedures. Accounting experts have ample experience with navigating the IRAS tax portal to ensure individuals and companies they represent comply fully with the tax filing procedures and deadline.

Related Posts

Tax Guide: Singapore Capital Allowances

By law, all Singapore Companies are required to file annual income tax returns to the…

Quick Guide: IAS 20 – Accounting for Government Grants

This year, the COVID-19 crisis has adversely impacted the global economy. Singapore is no exemption,…

Singapore Guide: ISCA FRB 6 – Accounting for Jobs Support Scheme

This year, the COVID-19 pandemic has inevitably adversely impacted the global economy. Singapore companies and…

Quick Guide: Singapore’s Enhanced Jobs Support Scheme (JSS)

The Singaporean government launched the Jobs Support Scheme (JSS) in late April as part of…