The Inland Revenue Authority of Singapore (IRAS) is the institution in charge of collecting taxes from the nation’s citizens and businesses. Its history can be traced back to 1947 when the Singapore Income Tax Department started its operations as part of that year’s Income Tax Ordinance. Since then, the institution has evolved until it was formally incorporated as the IRAS in 1992, as part of the structure of Singapore’s Ministry of Finance.

Since its incorporation, the IRAS has helped the government in financing its operating expenses through tax revenue, which contributes nearly 70% of the total revenues collected by the nation every year.

Purpose and Role of the IRAS

The primary role of the IRAS is to collect tax revenue through a comprehensive set of different taxes. On the other hand, the institution also provides its assistance to the government in matters related to tax treaties, tax legislation, and economic research regarding the impact of new or existing taxes on the country’s economy.

Among its responsibilities, the IRAS must conduct audits and other procedures conceived to ensure that tax returns filed by taxpayers (individuals or business organizations) are accurate. Additionally, they oversee the management of various digital platforms designed to facilitate tax-related procedures in Singapore such as the myTax Portal.

The IRAS must also evaluate the effectiveness and economic impact of the taxes it administers. One of its goals is to advise the government in taxation matters that promote the economic development of Singapore. This entails fostering a tax environment that fuels the nation’s economic growth.

Taxes Administered by the IRAS

The IRAS is responsible for enforcing the collection of different types of taxes in Singapore, including:

- Income Tax

- Corporate Tax

- Goods & Services Tax (GST)

- Withholding Tax

- Property Tax

- Stamp Duties

- Betting Tax

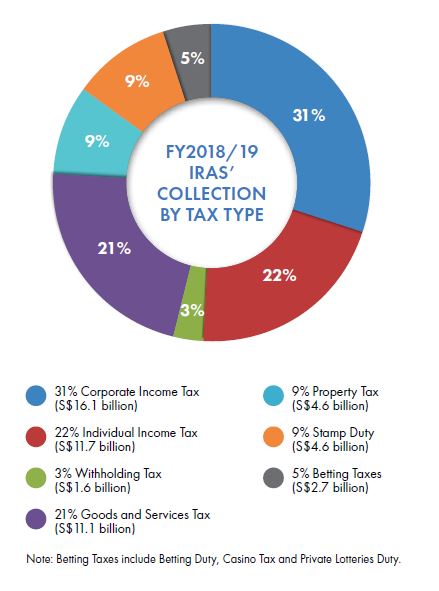

From those, the income tax and corporate tax account for more than 50% of the tax revenue collected by the IRAS, followed by the Goods & Services Tax (GST) which brings over 20% of government revenue.

Figures taken from the IRAS 2019 annual report

E-Service Platforms Supported by IRAS

The IRAS operates through a set of digital platforms designed to facilitate tax reporting for individuals and businesses. These platforms usually integrate with other government databases such as SingPass or CorpPass to verify the identity of the users and to maintain accurate and up to date records.

The most important platform managed by IRAS is the myTax portal, which is a user-friendly e-platform through which individuals and businesses can make important transactions such as:

- File and pay tax returns.

- Check employment income status.

- Request extensions to file tax returns after due dates.

- Perform searches within the IRAS database.

- Send correspondence to the IRAS safely.

- Update their contact information.

- View historical filings and pending account balances.

Tax Payments with the IRAS

For individuals, companies and businesses, the IRAS supports payment schemes that allow taxpayers to apply for financing if they don’t have enough funds to cover their tax bill before it is due.

The General Interbank Recurring Order, also known as GIRO, is the most common payment plan employed by individuals and businesses to pay for their taxes. This system integrates with financial institutions in Singapore and it offers 12-month payment plans to individuals and 3-month instalment plans for businesses.

When in doubt, seeking the advice of a qualified tax professional is a good option for more information on available IRAS tax schemes and ensuring your compliance with Singapore tax legislation.

Related Posts

Tax Guide: Singapore Capital Allowances

By law, all Singapore Companies are required to file annual income tax returns to the…

Quick Guide: IAS 20 – Accounting for Government Grants

This year, the COVID-19 crisis has adversely impacted the global economy. Singapore is no exemption,…

Singapore Guide: ISCA FRB 6 – Accounting for Jobs Support Scheme

This year, the COVID-19 pandemic has inevitably adversely impacted the global economy. Singapore companies and…

Quick Guide: Singapore’s Enhanced Jobs Support Scheme (JSS)

The Singaporean government launched the Jobs Support Scheme (JSS) in late April as part of…