A Tax Identification Number (TIN) is a unique set of numbers specifically assigned to an individual or organization to create a “fingerprint” that can facilitate their identification for the government and its agencies. In Singapore, individuals are assigned a Tax Reference Number issued by the Inland Revenue Authority of Singapore (IRAS) and businesses and other organizations are assigned with a Tax Identification Number known as the Unique Entity Number (UEN), assigned by the Accounting and Corporate Regulatory Authority of Singapore (ACRA) or other government agencies. In both cases, the number assigned is comprised of a 9 to 10-digit combination of numbers and letters.

How can individuals obtain their tax identification number in Singapore?

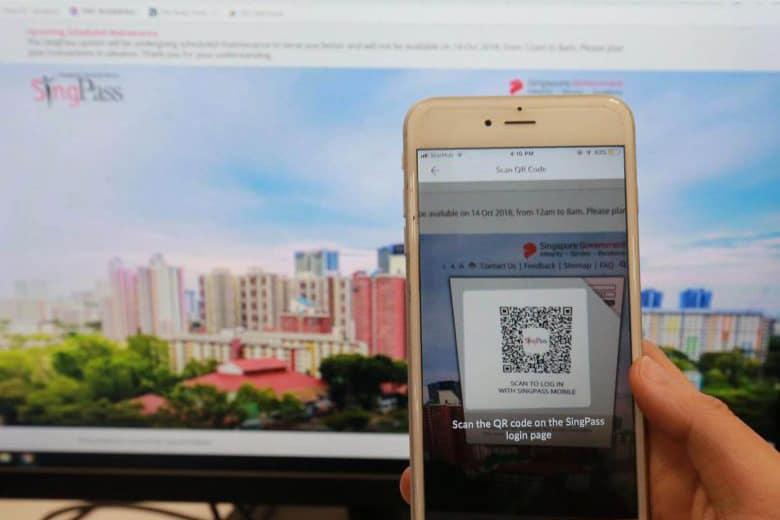

The Tax Identification Number for Singapore individuals is issued by the IRAS and it can be obtained by registering at the SingPass website or by applying for an IRAS Unique Account, usually required for foreigners. A Tax Reference Number will be sent, usually within 5 working days, and this number will subsequently identify the taxpayer for future procedures.

In both cases, the system will ask for either a National Registration Identity Card Number (NRIC) or a Foreign Identification Number (FIN) to complete the process and the application process can be completed through the government’s available online platforms.

How can organizations obtain their tax identification number in Singapore?

For entities, the Tax Identification Number in Singapore was formerly known as the Tax Reference number until January 2009. It is now known as the Unique Entity Number (UEN). This number is assigned by ACRA or other entities to identify the organization and provide a reference for registration and legal purposes.

Tax Identification Number in Singapore for New Organizations

A number of government entities can issue a Unique Entity Number for Singapore’s organizations and some these are:

- The Accounting and Corporate Regulatory Authority of Singapore (ACRA) – Local businesses and foreign companies can obtain their UEN through ACRA.

- The Registry of Societies of Singapore – A UEN is immediately assigned to societies that pay for their registration online.

- Singapore’s Ministry of Manpower (MOM) – MOM issues UENs for trade unions.

- Singapore’s Ministry of Culture, Community, and Youth (MCCY) – They issue UENs for charitable institutions and other non-profits.

Additionally, other entities also issue Unique Entity Numbers (UEN) for a wide range of organizations depending on their nature including the Ministry of Communications and Information (MCI), the Ministry of Defense (Mindef), and the Singapore Land Authority (SLA).

To find out where you can get the UEN for your particular organization you can check this website.

Tax Identification Number in Singapore for Existing Organizations

After the implementation of the Unique Entity Number (UEN) in 2009, the Tax Reference Number assigned to a particular organization back when it was registered will now serve as its UEN. Businesses and local companies will, therefore, retain their ACRA registration numbers and this number will now be their UEN. This measure was implemented to facilitate the migration to this new system and organizations can also check their current UENs through the government’s online UEN directory.

Related Posts

Tax Guide: Singapore Capital Allowances

By law, all Singapore Companies are required to file annual income tax returns to the…

Quick Guide: IAS 20 – Accounting for Government Grants

This year, the COVID-19 crisis has adversely impacted the global economy. Singapore is no exemption,…

Singapore Guide: ISCA FRB 6 – Accounting for Jobs Support Scheme

This year, the COVID-19 pandemic has inevitably adversely impacted the global economy. Singapore companies and…

Quick Guide: Singapore’s Enhanced Jobs Support Scheme (JSS)

The Singaporean government launched the Jobs Support Scheme (JSS) in late April as part of…