Singapore audit exemption for Private Limited Companies

In accordance with the Singapore Companies Act, private limited companies are required to have their financial statements audited by an auditor or public accountant at least once a year unless they pass the criteria for audit exemption. Proper records are required to be maintained by the company and be made available to auditors conducting the…

Read morePOSTED BY

Dev Team

Basic Roles and Features of Accounting Firms in Singapore

Accounting firms exist as an entity to provide professional accounting services to businesses. There are many areas of service that an accounting firm can provide, and they are not just confined to purely bookkeeping activity. Some of these include corporate finance, business recovery and liquidation, corporate secretarial and financial management advisory. Auditing and Statutory reporting…

Read morePOSTED BY

Dev Team

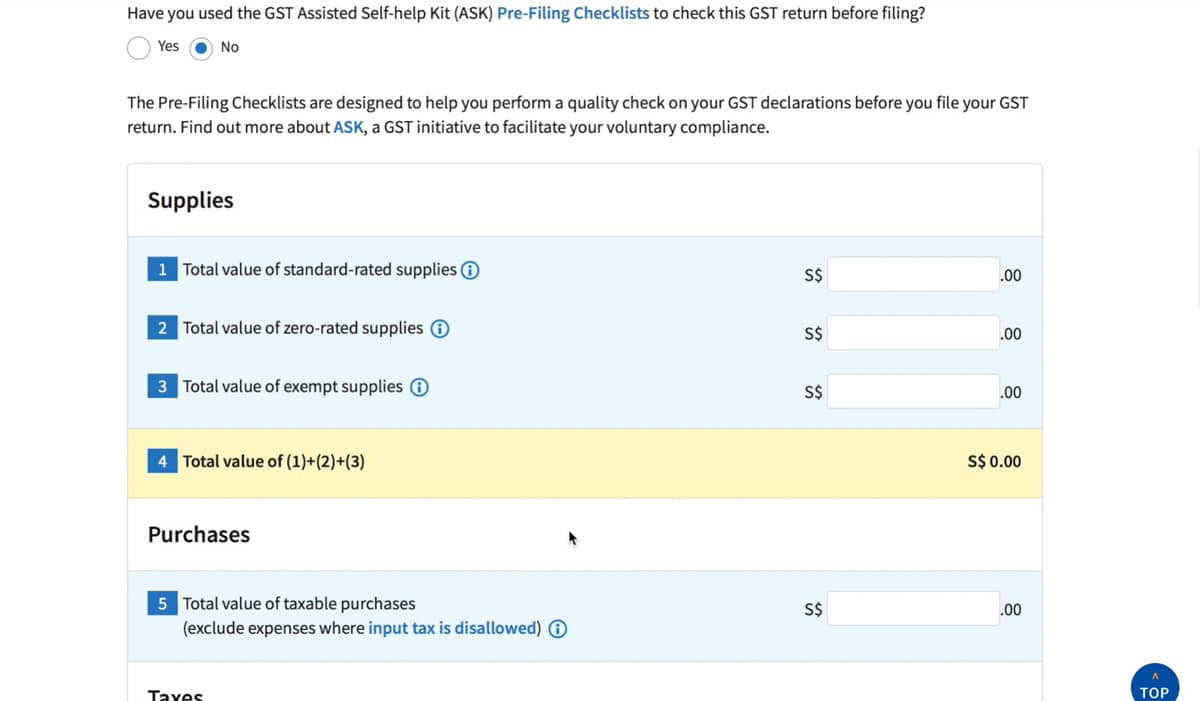

A basic guide to GST F5 Form Submission to IRAS

By legislation, GST registered companies are required to accomplish and report their GST claims to the Inland Revenue Authority of Singapore (IRAS) through the standardised GST F5 Form. Goods and Services Tax or GST is a broad-based consumption tax charged in addition to the price of imported goods, as well as a wide-ranging category of…

Read morePOSTED BY

Tax Dept

Conditions for becoming a GST Registered Company in Singapore

By Singaporean legislation, the Inland Revenue Authority of Singapore (IRAS) is tasked with the administration of taxes for individuals and companies in the city-state. When filing annual income tax returns, a GST registered company may claim back GST incurred on business expenses and quarterly GST returns are submitted to IRAS. What is GST? Goods and…

Read morePOSTED BY

Tax Dept

What is ASK and How Do Businesses in Singapore Benefit from It?

ASK stands for Assisted Self-Help Kit and it is a program developed by the Inland Revenue Authority of Singapore (IRAS) to help businesses in assessing the accuracy of their Goods and Services Tax (GST) filings. ASK may be implemented by businesses in Singapore voluntarily, or the IRAS may also invite the business to implement ASK,…

Read morePOSTED BY