Singapore, 14 January 2019 – The Monetary Authority of Singapore (MAS) will launch next month a new S$75 million Grant for Equity Market Singapore (GEMS). Announcing this at the UBS Wealth Insights conference today, Mr Heng Swee Keat, Minister for Finance and MAS Board Member, highlighted Singapore’s vision to serve as Asia’s centre for capital raising and enterprise financing. GEMS will be a three-year initiative to help enterprises seeking to raise capital through Singapore’s equity market.

GEMS will have three components:

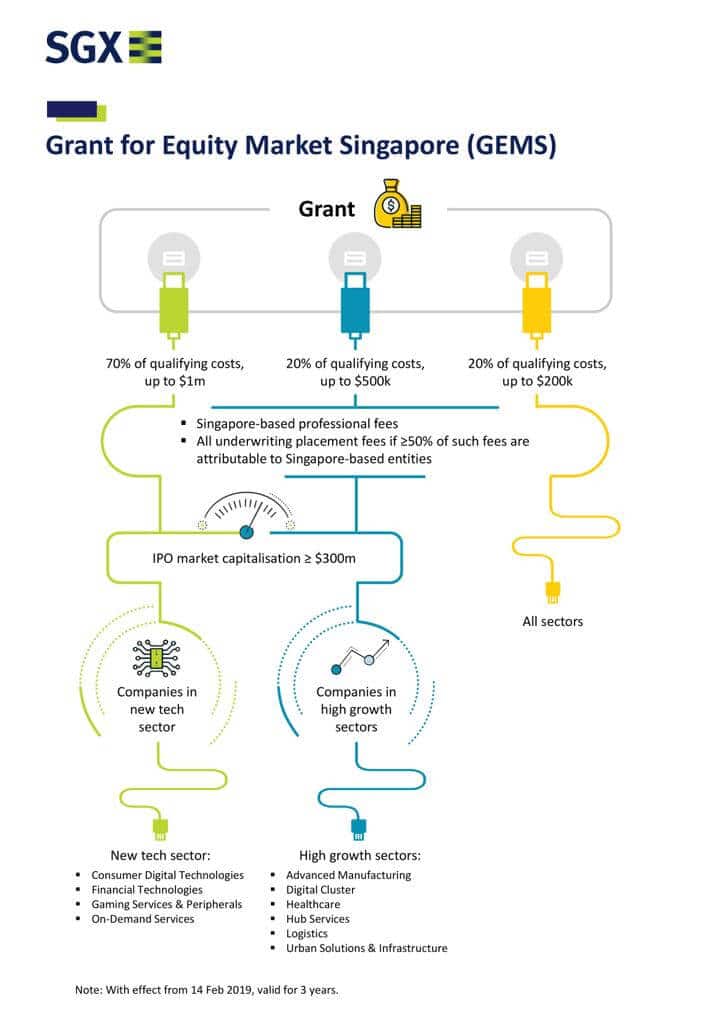

a. Listing Grant: to facilitate enterprises seeking a listing on Singapore Exchange (SGX) by defraying part of their Initial Public Offering (IPO) costs;

b. Research Talent Development Grant: to strengthen Singapore’s research coverage of enterprises by grooming equity research talent; and

c. Research Initiatives Grant: to support crowd-sourced initiatives to propel the development of Singapore’s equity research ecosystem.

Listing Grant

Singapore’s equity market has supported the fund raising needs of a wide range of enterprises when they choose to list on SGX. This includes listings of foreign enterprises, real estate investment trusts and business trusts. The listing grant, with different funding tiers, will further encourage eligible enterprises across a range of sectors to list on SGX. The eligibility and funding tiers are listed below:

| Eligibility | Level of funding |

| Enterprises in new technology sector1 with minimum market capitalisation of S$300 million | Co-fund 70% of eligible listing expenses, with grant capped at S$1 million |

| Enterprises from high growth sectors2 with minimum market capitalisation of S$300 million | Co-fund 20% of eligible listing expenses, with grant capped at S$500,000 |

| Enterprises from all sectors with no minimum market capitalisation | Co-fund 20% of eligible listing expenses, with grant capped at S$200,000 |

Research Talent Development Grant

Enhanced research coverage, particularly for mid and small-cap enterprises, can help improve investor knowledge, which will in turn facilitate price discovery and liquidity. The research talent development grant is designed to groom a pipeline of equity research analysts and retain experienced research talent to initiate research coverage primarily of listed mid and small-cap enterprises. The grant will co-fund locals in the following areas:

- 70% of the salaries for fresh graduates hired as equity research analysts; and

- 50% of the salaries for re-employed experienced equity research analysts.

Research Initiatives Grant

MAS will earmark funds to crowd-source initiatives that will propel the development of Singapore’s equity research ecosystem. Such initiatives can include publication of industry or sector primers, innovative ways to distribute research and disseminate enterprise information to investors.

—

GEMS, funded under the Financial Sector Development Fund (FSDF), will take effect from 14 Feb 2019 and MAS will release more details closer to the date. An infographic of GEMS can be found in the Annex. Interested applicants can write to fsdf@mas.gov.sg for more information.

—

Additional information

About the Financial Sector Development Fund (FSDF)

The FSDF was established in 1999 under the Monetary Authority of Singapore Act for the following purposes:

(a) to promote Singapore as a financial centre;

(b) to develop and upgrade skills and expertise required by the financial services sector;

(c) to develop and support educational and research institutions, research and development; and

(d) to develop infrastructure to support the financial services sector in Singapore.

Source: Monetary Authority of Singapore as at 29th April 2019

Related Posts

Mr Paul Wan honored by International Accounting Bulletin

Morison KSi has announced that it has rebranded as Morison Global. This rebrand celebrates the…

Accounting fraud takes a new dimension in China

China’s biggest accounting firm Ruihua CPA’s is being investigated by the China Securities Regulatory Commission…

Singapore’s first cybersecurity framework

The much discussed Cybersecurity Act 2018 (the Act), which was passed by the Singapore Parliament…

Temasek unit invests in blockchain-based platform iSTOX

THE Singapore Exchange (SGX) and Temasek Holdings holdings subsidiary Heliconia Capital Management have invested in…