Singapore Budget 2020 – Goods and Services Tax (GST)

NAVIGATION GST Rate 1.GST RATE As announced in Budget 2018, the GST rate is planned to go up from 7% to 9% between year 2021 and 2025. This is necessary as the Minister foresee support in higher healthcare and other needs in the near future. In Budget 2020, the Finance Minister had unveiled that…

Read morePOSTED BY

Tax Dept

Using the GST F7 Form to Correct GST Filing Errors

Goods and Services Tax (GST) is an indirect tax collected by the Inland Revenue Authority of Singapore (IRAS) and it is applied to most goods and services sold to consumers and businesses within the country. GST must be reported and paid by companies every three months and this quarterly GST submission is usually prepared by…

Read morePOSTED BY

Tax Dept

Singapore IRAS GST legislation: Tax Facts

Goods and Services Tax or GST is a broad-based consumption tax charged in addition to the price of imported goods, as well as a wide-ranging category of goods and services in Singapore. GST is administered by IRAS and is more commonly known as the Value-Added Tax (VAT) in overseas developed countries such as Japan or…

Read morePOSTED BY

Tax Dept

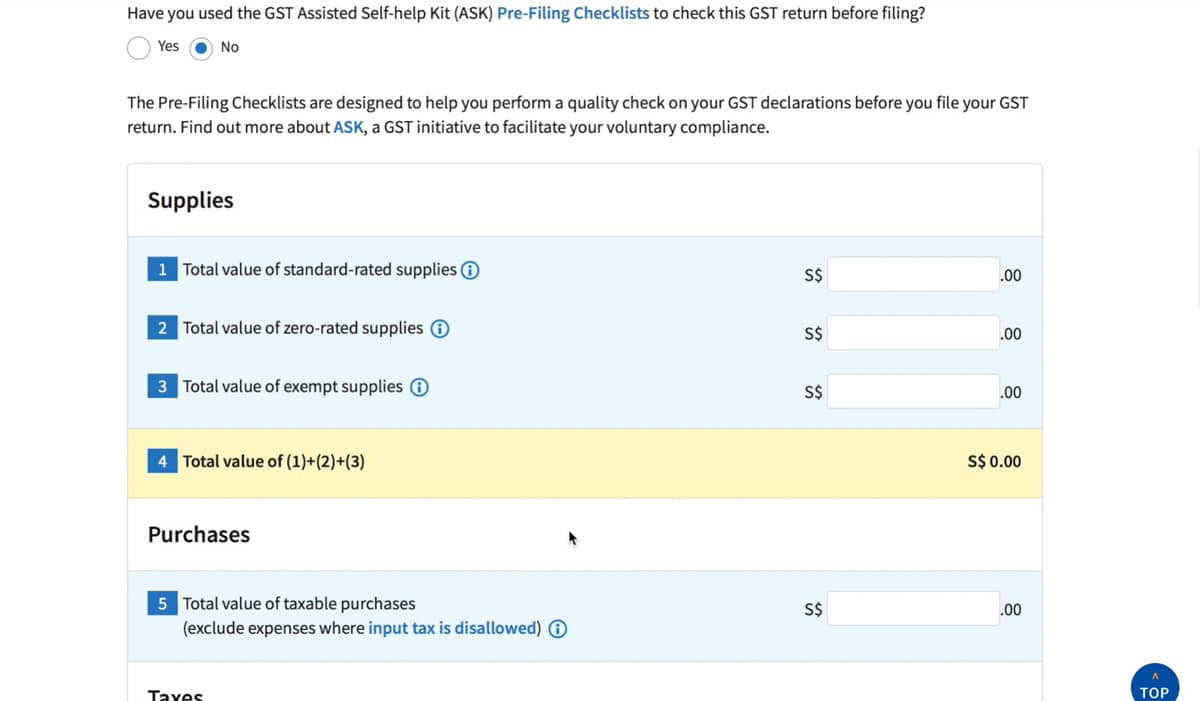

A basic guide to GST F5 Form Submission to IRAS

By legislation, GST registered companies are required to accomplish and report their GST claims to the Inland Revenue Authority of Singapore (IRAS) through the standardised GST F5 Form. Goods and Services Tax or GST is a broad-based consumption tax charged in addition to the price of imported goods, as well as a wide-ranging category of…

Read morePOSTED BY