Tax Season 2020: Income Tax Filing Mistakes to Avoid

The income tax filing process for Singapore individuals and employees has changed as a result of Circuit Breaker policies implemented by the government to contain the spread of the COVID-19 virus in the country. Deadlines have been extended, payments have been deferred, and the prescribed method of filing income tax returns now favours digital channels…

Read morePOSTED BY

Tax Dept

Safety Measures for IRAS Income Tax Filing YA2020

The Singapore tax season traditionally starts in March to April when annual tax filing begins for both nationals and foreigners. However, the recent health emergency triggered by the coronavirus outbreak has caused changes to deadlines and affected this year’s tax payments, filing procedures, and schedules. In this regard, the Inland Revenue Authority of Singapore (IRAS)…

Read morePOSTED BY

Tax Dept

Singapore Tax Guide: Preparing for IRAS Income Tax filing YA2020

Companies are required to file annual income tax returns to the Inland Revenue Authority of Singapore (IRAS) and pay income tax at the prevailing Singapore corporate tax rate charged on chargeable income. The final IRAS tax rate will then be levied on the chargeable income which will work out the final tax amount payable to…

Read morePOSTED BY

Tax Dept

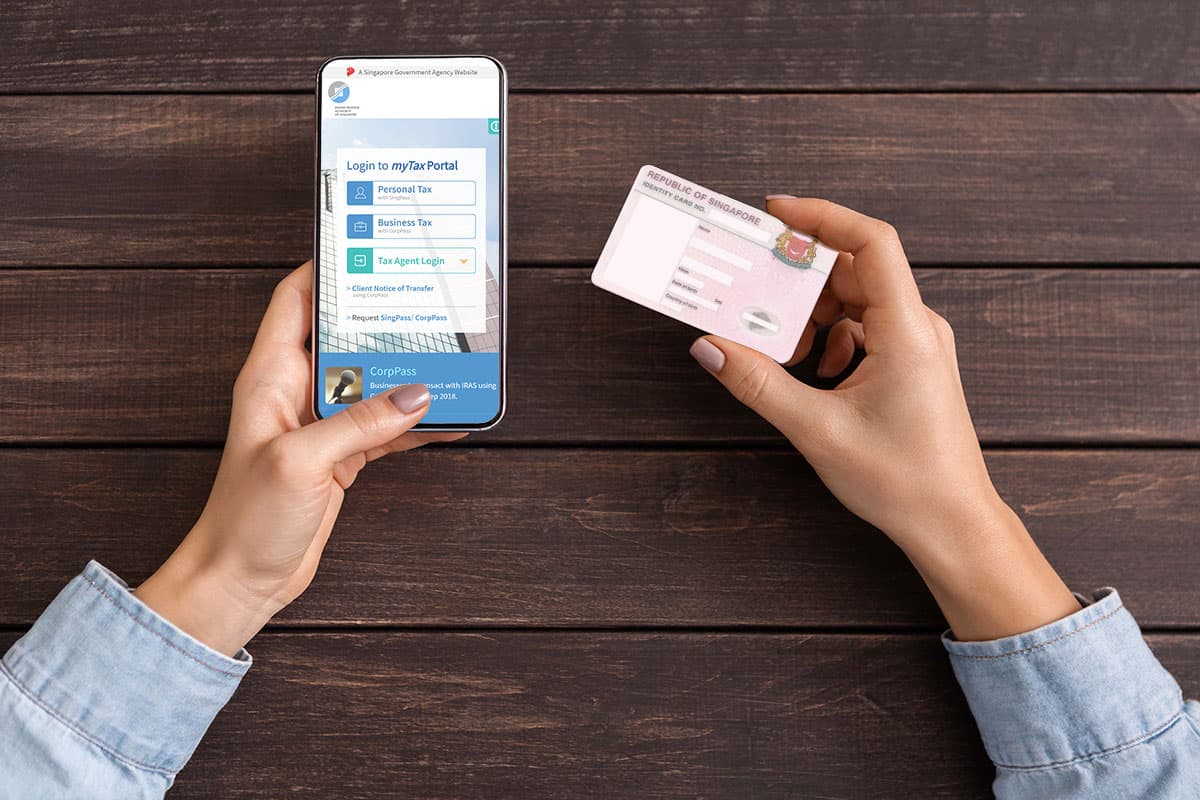

IRAS Portal Guide: How to login to the myTax Portal

The Inland Revenue Authority of Singapore (IRAS) has a dedicated IRAS login portal for individuals or corporations to perform various tax e-services online. Individuals are required to file annual income tax returns to (IRAS) and pay income tax at the prevailing Singapore personal IRAS income tax rate charged on chargeable income. Companies are also required…

Read morePOSTED BY