An Overview of the Singapore Corporate Tax Rate

Companies are required to file annual income tax returns to the Inland Revenue Authority of Singapore (IRAS) and pay income tax at the prevailing Singapore corporate tax rate charged on chargeable income. Chargeable income is defined as the total taxable income less deductible expenses. The final IRAS tax rate will then be levied on the…

Read morePOSTED BY

Tax Dept

Singapore IRAS GST legislation: Tax Facts

Goods and Services Tax or GST is a broad-based consumption tax charged in addition to the price of imported goods, as well as a wide-ranging category of goods and services in Singapore. GST is administered by IRAS and is more commonly known as the Value-Added Tax (VAT) in overseas developed countries such as Japan or…

Read morePOSTED BY

Tax Dept

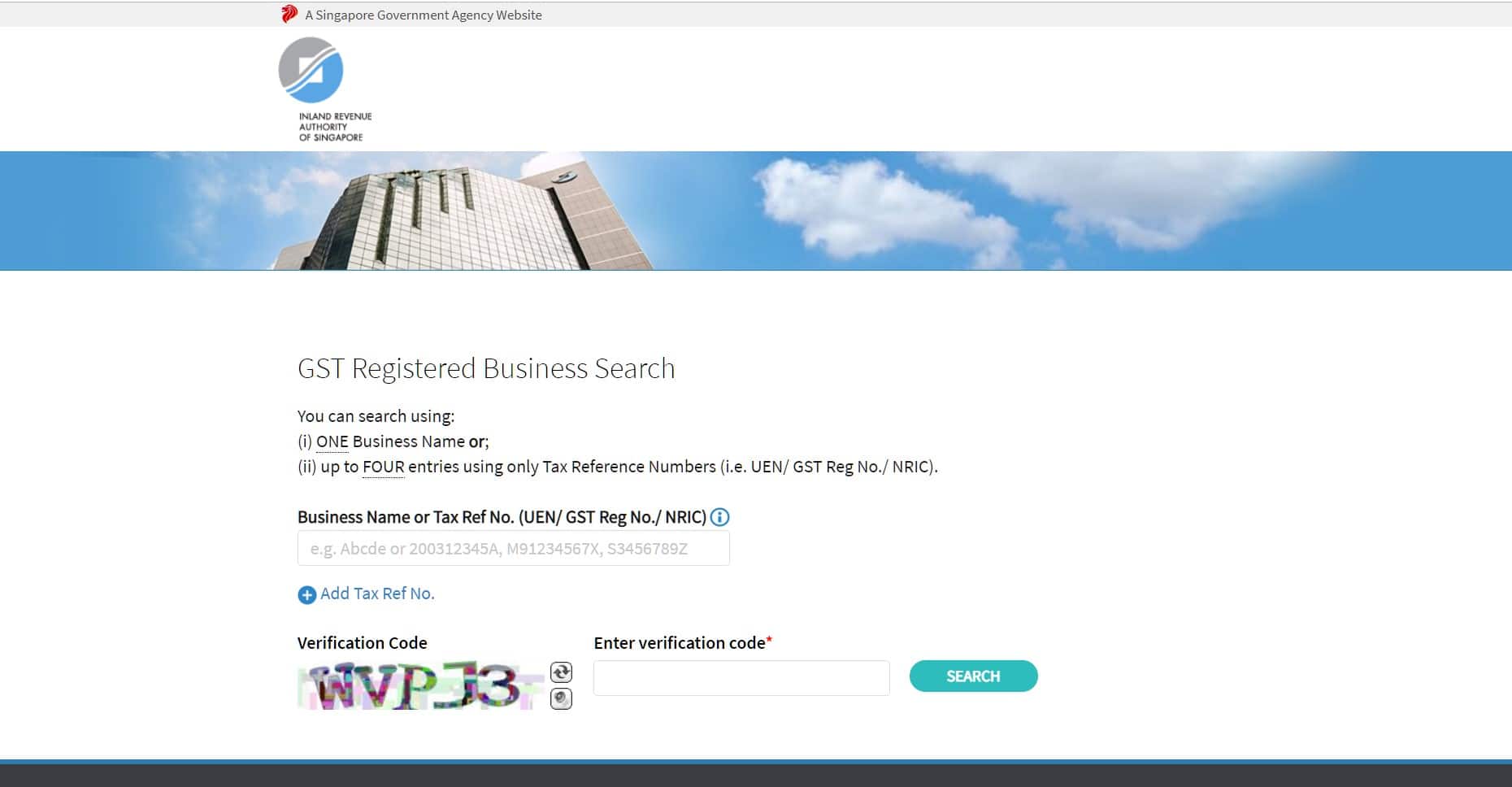

Singapore Tax Guide: Check a Company’s GST Registration Number

By Singaporean legislation, a GST registered company may claim back GST incurred on business expenses and file quarterly GST returns to the Inland Revenue Authority of Singapore (IRAS). Goods and Services Tax or GST is a broad-based consumption tax charged in addition to the price of imported products, as well as a wide-ranging category of…

Read morePOSTED BY

Tax Dept

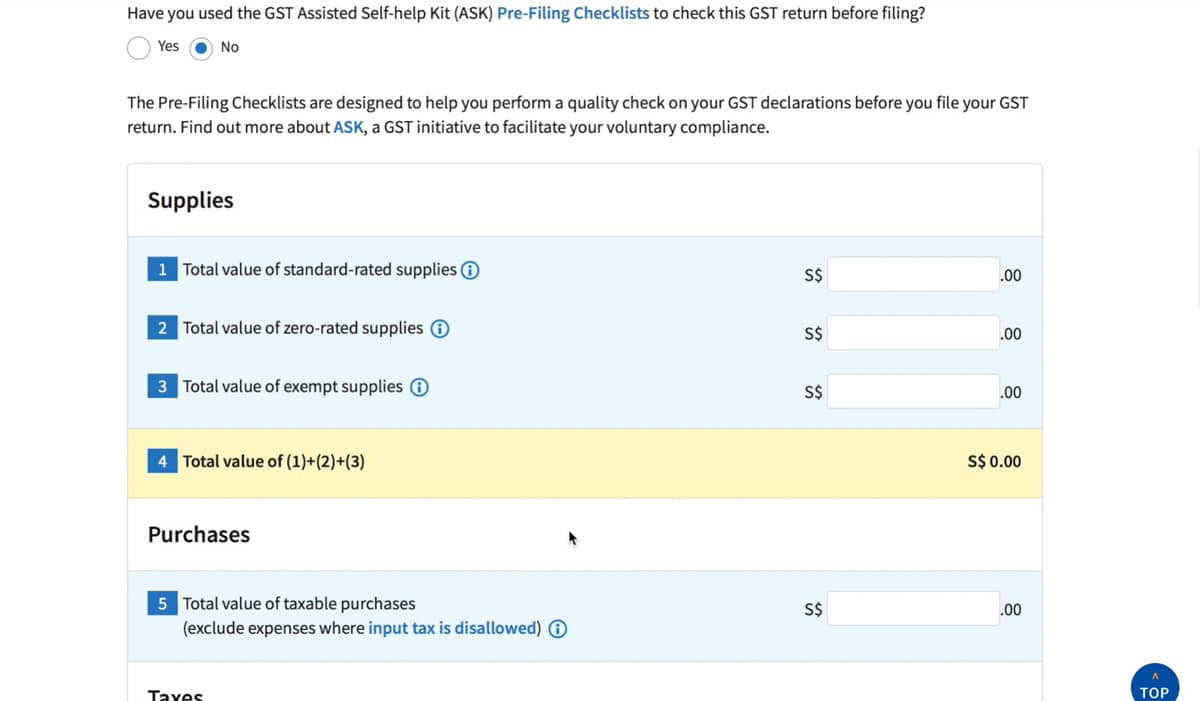

A basic guide to GST F5 Form Submission to IRAS

By legislation, GST registered companies are required to accomplish and report their GST claims to the Inland Revenue Authority of Singapore (IRAS) through the standardised GST F5 Form. Goods and Services Tax or GST is a broad-based consumption tax charged in addition to the price of imported goods, as well as a wide-ranging category of…

Read morePOSTED BY

Tax Dept

Conditions for becoming a GST Registered Company in Singapore

By Singaporean legislation, the Inland Revenue Authority of Singapore (IRAS) is tasked with the administration of taxes for individuals and companies in the city-state. When filing annual income tax returns, a GST registered company may claim back GST incurred on business expenses and quarterly GST returns are submitted to IRAS. What is GST? Goods and…

Read morePOSTED BY