Singapore Tax Guide: IRAS Corporate Tax Calculator

Individuals (employees or sole proprietors) and companies are required to file annual income tax returns to the Inland Revenue Authority of Singapore (IRAS) and pay income tax at the prevailing Singapore corporate tax rate charged on chargeable income. The final IRAS tax rate will then be levied on the chargeable income which will work out…

Read morePOSTED BY

Tax Dept

Tax Guide: Singapore Tax Identification Number

A Tax Identification Number (TIN) is a unique set of numbers specifically assigned to an individual or organization to create a “fingerprint” that can facilitate their identification for the government and its agencies. In Singapore, individuals are assigned a Tax Reference Number issued by the Inland Revenue Authority of Singapore (IRAS) and businesses and other…

Read morePOSTED BY

Tax Dept

Singapore Tax Guide: IRAS Individual Income Tax Rate

Individuals are required to file annual income tax returns to the Inland Revenue Authority of Singapore (IRAS) and pay income tax at the prevailing Singapore personal IRAS income tax rate charged on chargeable income. Chargeable income is defined as total taxable income less deductible expenses. The final IRAS tax rate will then be levied on…

Read morePOSTED BY

Tax Dept

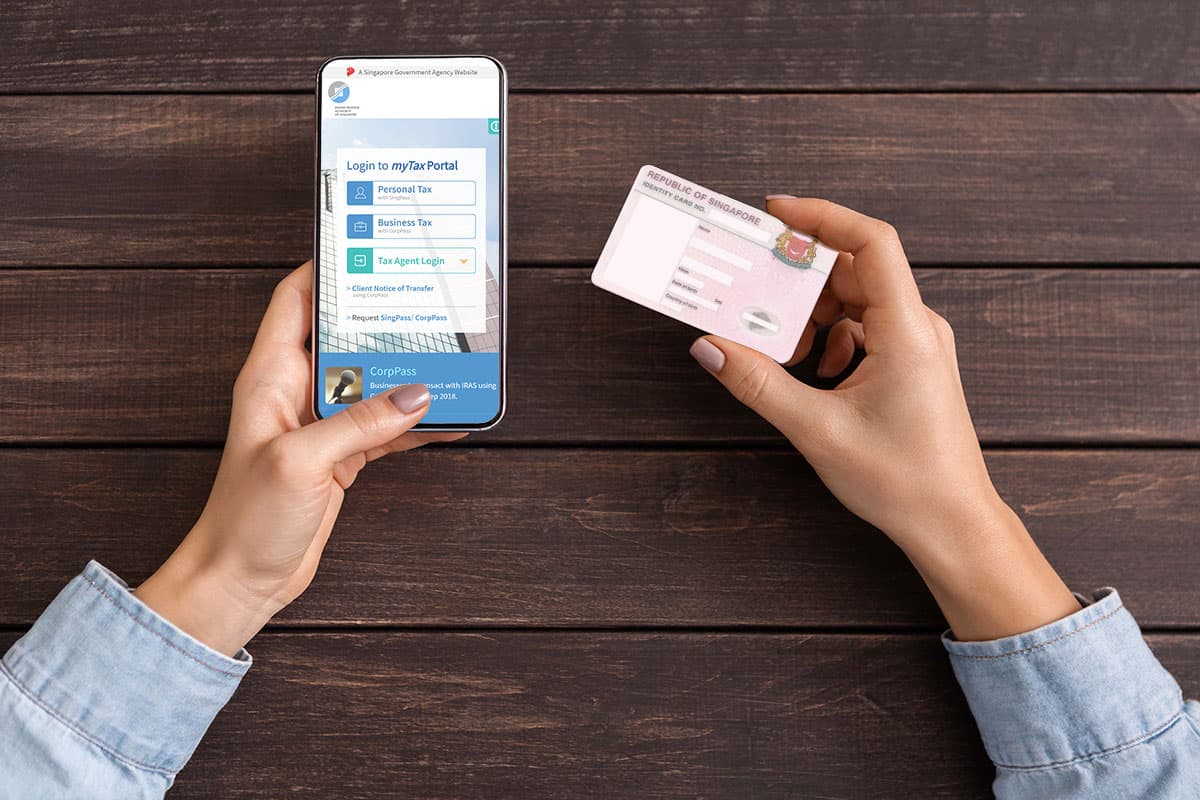

IRAS Portal Guide: How to login to the myTax Portal

The Inland Revenue Authority of Singapore (IRAS) has a dedicated IRAS login portal for individuals or corporations to perform various tax e-services online. Individuals are required to file annual income tax returns to (IRAS) and pay income tax at the prevailing Singapore personal IRAS income tax rate charged on chargeable income. Companies are also required…

Read morePOSTED BY

Tax Dept

What is VAT and How Does It Work in Singapore?

Value-Added Tax (VAT) is a type of indirect tax collected on the value of goods and services consumed by individuals and businesses to alleviate the effect of direct taxes such as income tax. In Singapore, VAT is known as Goods and Services Tax (GST) and it is applied to most of the products and services,…

Read morePOSTED BY