Last Updated: 24 Feb 2019

Tax compliance is part and parcel of every business in almost all countries. Without proper tax compliance, businesses will run into trouble with tax authorities. Fines, penalties, freezing bank accounts, summons, court’s attendances, imprisonment, not allowing errant taxpayers leaving the country are some of the steps that may be taken by tax authorities for non-tax compliance and under-declaration on income.

A competent tax consultant/advisor if appointed, will normally work closely with taxpayers, glean valuable insights into their client’s business needs and concerns, provides quality services with utmost integrity and advices to their clients so as to help businesses minimize taxes as well as complying with tax laws. Where possible, he will also assist to provide feedback to tax authorities in the formulation and refining of tax policies and practices to ease compliance requirements and hence, facilitating business growth that benefits all parties. Therefore, it is important to choose a right tax consultant/agent that is compliant in all tax matters to be your business partner.

With the ever changing tax rules and new policies/incentives being implemented, it may be too technical for businessmen to understand and to comply with their annual tax obligations themselves. The following are some of the examples:-

1 – Incorrect Declarations

Unexpected/repeated errors may not be detected when declaring their yearly tax return. With a competent consultant/advisor in place, he may assist to perform an overall review of their past tax declarations. Should there be any errors detected, he will assist the taxpayer to disclose voluntarily the errors made at an early stage so as to lower/waive penalties for incorrect/under-declaration of income.

2 – Minimising Tax Exposure

To avoid unnecessary taxes in more than one country, taxpayers/their tax agents will need to be familiar with the tax laws in the countries that they have/intended to do business with. This will help businesses minimize tax exposure in both jurisdictions, thus lowering their tax burden especially where the income is being taxed in the source country and yet taxed in the country of remittance (home country). Tax treaties in different jurisdictions are complex, tax treatment varies depending on the nature of transactions involved and may not be easily understood by businessmen.

3 – Multinational Corporations

Multinational corporations (MNCs) that operate on a regional/global basis tend to have cross-border intercompany services/transactions. Such an arrangement may result in erosion of profit from a higher tax jurisdiction to a lower tax jurisdiction or even to a tax heaven country. With the current strict transfer pricing regulations and guidelines implemented on most countries, all cross-border intercompany transactions must be properly and legally structured and documented. As this is a complex issue, it would be best to sort out with your competent tax consultants/advisors.

4 – Withholding Tax

Withholding tax that needs to withhold and accounted for to the relevant tax authorities on certain payments due to foreign tax resident recipients often at times overlooked/omitted. As a result, late penalties have been imposed by tax authorities.

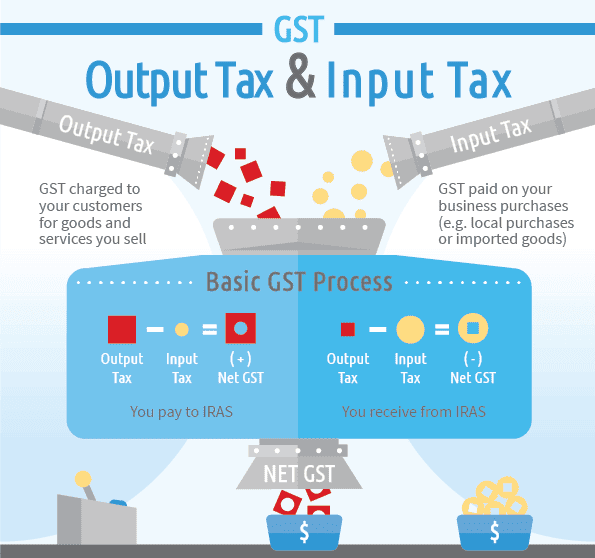

5 – Indirect Taxes

Indirect taxes such as Goods & Services Tax (GST). It has been noted that some businesses still unaware of the compulsory GST registration if their past 4 quarters taxable supplies reached the threshold of SGD1 million or failed to keep track of their next 12 months taxable supplies may exceed the said threshold. Hence, they became panic when queried by the tax authority and may result in unexpected payment of GST retrospectively on taxable supplies and penalties that were not accrued for.

To help all GST-registered businesses voluntarily complied with compliance requirements, IRAS has rolled out two main initiatives – Assisted Self-Help Kit (ASK) and Assisted Compliance Assurance Programme (ACAP). These packages if adopted will help businesses review the correctness of their past and present GST submissions and discover GST errors made early and to minimize penalties if voluntarily disclosed to IRAS.

6 – GST, ASK and ACAP

Businesses may also engage tax consultant/advisor to assist with the ASK/ACAP annual review. However, businesses currently/intend to enjoy under certain GST schemes such as Major Exporters, Third Party Logistics, Import GST Deferment, etc. are a pre-requisite to carry-out either the ASK/ACAP annual review performed by a GST accredited member of SIATP.

—

If you encountered any tax issues be it individual, partnership, corporate or GST matters, we Paul Wan & Co., a mid-tier Chartered Accountants firm has a team of dedicated, capable, well-trained and experienced tax professionals accredited by SIATP in both income tax and GST, are pleased to meet up and assist you. You can find our tax portal one click away.

Related Posts

THE SINGAPORE BUDGET 2023

We have pleasure in enclosing an extract of the Singapore Budget 2023 – Tax Changes…

Singapore Budget 2021 – Others

NAVIGATION Enhancement of Electric Vehicle (EV) Early Adoption Incentive (EEAI) Transitional Offset Measures for Vehicles…

Singapore Budget 2021 – Individuals and Households

NAVIGATION Individual Income Tax Rate GST Voucher (GSTV) – Cash Special Payment GST Voucher (GSTV)…

Singapore Budget 2021 – Goods and Services Tax (GST)

NAVIGATION GST Rate Imposition of GST on Imported Low-Value Goods Change of Basis for Determining…